Moderando la influencia de la diversidad idiosincrásica en las relaciones entre la ética contable y la calidad de los informes financieros.

Moderating Influence of Idiosyncratic Diversity on the Relationship between Accounting Ethics and Financial Reporting Quality

Ofuan James Ilaboya

University of Benin (Nigeria)

https://orcid.org/ 0000-0002-8161-8245

Oscar Chijioke Mgbame

University of Benin (Nigeria)

https://orcid.org/ 0000-0003-3637-7021

Okhae James Ibhadode

Niger Delta Development Commission (Nigeria)

https://orcid.org/ 0009-0002-6683-6911

Godwin Ohiokha

Edo University (Nigeria)

https://orcid.org/ 0000-0001-8274-6559

godwin.ohiokha@edouniversity.edu.ng

RESUMEN

Propósito- Este estudio investiga sobre la influencia moderadora de la diversidad idiosincrásica en las relaciones entre la ética contable y la calidad de los reportes financieros, en el contexto de los interminables colapsos corporativos y su efecto anteriores en la profesión de la contabilidad.

Diseño/Metodología/Aproximación- El estudio se fundamenta en la filosofía positivista con una estrategia de investigación deductiva. Empleamos una triangulación teórica combinando la teoría de la agencia y la teoría de la dependencia de recursos. El tamaño de la muestra, de trescientos ochenta y cuatro encuestados, se estableció utilizando el enfoque de Cochran (1977) para la población infinita. Los datos primarios se recopilaron para el estudio mediante un enfoque de encuesta y se analizaron mediante la técnica de regresión de mínimos cuadrados ordinarios.

Logros- El estudio valida de manera significativa la relación entre la ética contable y la calidad de los informes financieros en la literatura existente. Además, encontramos como significativa la influencia moderadora de la diversidad idiosincrásica en la relación entre la ética contable y la calidad de la información financiera

Implicaciones prácticas- El estudio muestra la importancia estratégica de los profesionales de la contabilidad de diversas nacionalidades para brindar informes financieros de calidad en Nigeria.

Limitaciones/implicaciones- La investigación propuesta es un estudio a nivel nacional para Nigeria, que mejora la amplia generalización de los resultados.

Originalidad/valor- Si bien los estudios existentes han considerado principalmente la dinámica de la ética contable y la información financiera, el estudio actual se centra en comprender la influencia moderadora de la diversidad idiosincrásica en la relación entre la ética contable y la calidad de la información financiera. Además, el enfoque adoptado a nivel nacional evitó la limitación de la micro-numerosidad de los datos, que ha sido la pesadilla de importantes estudios anteriores.

PALABRAS CLAVE

Diversidad idiosincrásica; calidad de la información financiera; ética contable; integridad; comportamiento profesional.

ABSTRACT

Purpose- The study investigates the moderating influence of idiosyncratic diversity on the relationship between accounting ethics and financial reporting quality, against the backdrop of the unending corporate collapses and their antecedent effect on the profession of accounting.

Design/Methodology/Approach- The study is anchored on the positivist philosophy with a deductive research strategy. We employed theoretical triangulation having combined agency theory and resource dependency theory. The sample size of three hundred and eighty-four respondents was established using the Cochran (1977) approach for the infinite population. Primary data were collected for the study through a survey approach and analysed using the Ordinary Least Squares regression technique.

Findings- The study validates the significant relationship between accounting ethics and financial reporting quality in extant literature. In addition, we found a significant moderating influence of idiosyncratic diversity on the relationship between accounting ethics and financial reporting quality.

Practical implications- The study demonstrates the strategic importance of accountants of diverse nationalities in delivering quality financial reporting in Nigeria.

Research limitations/implication- The research is a country-wide study of accountants in Nigeria which enhances the extensive generalization of the outcomes.

Originality/value- While extant studies have mainly been preoccupied with the accounting ethics-financial reporting dynamics, the current study focuses on understanding the moderating influence of idiosyncratic diversity on the relationship between accounting ethics and financial reporting quality. In addition, the country-wide approach adopted circumvented the limitation of micro numerosity of data which has been the bane of major prior studies.

KEYWORDS

Idiosyncratic diversity; financial reporting quality; accounting ethics; integrity; Professional behaviour.

Clasificación JEL: M14, M49.

MSC2010: 91B74.

1. INTRODUCTION

Extant literature is replete with studies on the nexus between professional ethics and financial reporting quality (Aluwi et al., 2023; Choi & Pae, 2011; Eginiwin & Dike, 2014; Enofe et al., 2015; Enyi et al., 2019; Karasioglu & Humta, 2022; Mahdavikhou & Khotanlou, 2011). Within the Nigerian research community, vivacious debate among academics, policy formulators, and the informed public has found no consensus position on the relationship between professional ethics and financial reporting quality. The lack of harmony may be due largely to the measurement problem of financial reporting quality using the earnings management approach (Im & Nam, 2019), the problem of multicollinearity arising from the micronumerosity of research data (Blanchard, 1998; Kertarajasa et al., 2019; Musa, 2019), limitations of the sociology of small group, arising from local government, state or sectoral consideration, instead of more robust approaches of country-wide or cross-country consideration (Aifuwa, et al., 2018; Enofe et al., 2015), and unscientific sample size determination, which is capable of undermining the internal and external validity of some existing studies (Mubaraq et al., 2019; Musa, 2019).

Presently, little is known about the interactive influence of idiosyncratic diversity management on the relationship between professional or accounting ethics and financial reporting quality. The rationale behind this present contribution is encapsulated in the complementary relationship between ethics, diversity management, and financial reporting quality advanced by Labelle et al. (2010). Our deviation is premised on the fact that we expect that heterogenous professionals in an organisation will help in developing cohesion which will turn lead to the success of the group according to Sheppard (1964). Professional heterogeneity has the potential for creativity and innovation and by implication, enhanced quality reporting. Diversity leads to knowledge transfer, improved learning, and informed decision-making.

The current study on the moderating influence of idiosyncratic diversity management on the accounting ethics-financial reporting quality dynamics is designed to x-ray the dark side of the existing empiric. First, instead of the conventional approach of discretionary accrual as a proxy for financial reporting quality, we adopted the Braam and Beest (2013), International Accounting Standards Board’s conceptual framework approach, which is considered more appropriate against the backdrop of the adoption of the International Financial Reporting Standards in Nigeria since the year 2012. The choice of Cochran’s (1977) sample size determination for an infinite population is considered more scientific and more representative of the population of the study and will no doubt enhance the accuracy of the findings. Instead of the usual state, local government, and sectoral consideration in the extant literature, the present study is a county-wide approach, with the benefit of conceptual equivalence, which eliminates the problem of linguistic onus since the researchers and respondents enjoy the benefit of uniformity of language. Lastly, issues of ethical consideration are more concerned with human behaviour which is better studied by eliciting responses from the principal actors, instead of extrapolating semblances of the variables from relatively static financial statements, hence the choice of primary data.

Following the introduction, the paper is structured as follows: Section two provides a conceptual and empirical review of extant literature to clarify the concepts and present a better insight into the existing relationship between the variables. Section three presents the methodology, with emphasis on the philosophy, strategy, and design of the research, data type and analytical technique. Section four focuses on the estimation results and discussion of findings, and section five draws the conclusion and advances the recommendations.

2. LITERATURE REVIEW AND HYPOTHESES DEVELOPMENT

Conceptualisation: Financial Reporting Quality, Accounting Ethics, and Diversity Management

Financial Reporting Quality

In Nigeria, the responsibility for the preparation of financial statements is vested in company directors (S. 377(1), Companies and Allied Matters Act, 2020). The financial statements required to be prepared by the directors are listed in Section 377(2) (a-i) of CAMA 2020 read with International Accounting Standard No. 1 (Presentation of financial statements). Financial statements are general-purpose statements directed at diverse user groups whose interests hardly coincide. The end-product of financial reporting and financial statements is financial information which is required by different users to make informed decisions. The decision relevance of financial accounting information is a function of the quality of the reporting process. The higher the quality of financial reporting, the more impressive the satisfaction achieved by the users of the financial reports (Herath & Albarqi, 2017). The International Accounting Standards Board defines financial reporting quality as financial statements that provide accurate and fair information about the underlying financial position and economic performance of an entity. Financial reporting information is user-specific, which presupposes that different user of financial accounting information has contrasting proclivity. The problem of user-specificity portends a great difficulty in the definition, description, and measurement of the concept of quality (Botosah, 2004).

In ordinary parlance, quality is used to describe the characteristics or features possessed by a thing, in this case, financial reporting. CFA, 2020 defined quality as the totality of features, and inherent or assigned attributes of a product, person, process, service, and system that bear on its ability to show that it meets expectations or satisfies stated wants requirements or specifications. Chartered Financial Analyst Institute (CFA, 2020) posits that high-quality reporting provides decision-useful information, that is relevant and faithfully represents the economic reality of the company’s activities during the reporting period. As well as the company’s financial condition at the end of the period.

The imprecise nature of the concept of financial reporting quality has advanced different terminologies such as earnings management, financial restatement, and timeliness. However, none of the dimensions best describes the concept. Healy (1985) may have first applied the accrual model in the measurement of earnings management. He identified discretionary accrual based on the relationship between total accrual and some hypothesized explanatory factors (Callao et al., 2017). According to Healy (1985), earnings management will result where TA= (DA + NDA) ≠ 0. Where TA is total accrual, DA is discretionary accrual, and NDA is non-discretionary accrual (1).

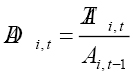

The DeAngelo (1986) accrual model assumed that discretionary accrual follows the random walk processes. According to him, discretionary accrual is the difference between the non-discretionary accrual of the current and previous year (2).

where DA is discretionary accrual, TA is total accrual in year t, and A is total assets in year t-1.

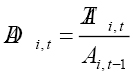

Jones (1991) used the regression approach to model nondiscretionary accrual by regressing total accrual as a dependent variable on explanatory variables of change in revenue and gross value of property plant and equipment. The residual is thereafter combined with total accrual, change in revenue, and property plant and equipment data to extricate abnormal from total accrual (3).

Where Tait is total accrual in year t, Ait-1 is total assets in year t-1, ∆REVit is change in revenue in year t, and PPTit is property plant and equipment in year t.

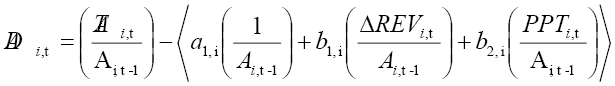

The DeFond and Jiambalvo (1994) cross-section Jones model was developed to remedy the limitations of the standard Jones model. It involves a separate estimation of the industry-year data, thereafter, the outcome is combined with the firm-specific data to generate the discretionary accrual. The model is based on the assumption that discretionary accrual may be industry-specific (4).

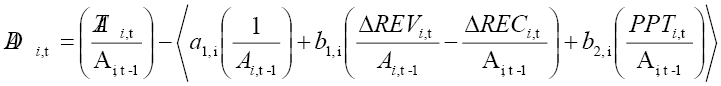

Dechow et al.(1995) modified the Jones Model evolved from the inability of the standard Jones model to detect revenue-based manipulations. The major difference between the standard Jones and the modified Jones model is the subtraction of change in trade receivable from the change in revenue (5)

These different accrual measures of financial reporting quality have come under serious criticism in the recent past. The demand for a long series of data by the Jones and modified Jones model raises the limitation of survivorship bias according to Peasnell et al. (2000). It is also believed that the standard Jones model could not detect revenue-based manipulations which was the basis of the Dechow et al. (1995) model.

Against the backdrop of the limitations and coupled with the adoption of the International Financial Reporting Standard, the Braam and Beest (2013) IASB framework evolved as a measure of financial reporting quality. The usefulness of financial reporting information is a function of its qualitative characteristics (IASB, 2010). The fundamental attributes, complemented by the enhancing attributes, determine the quality of the financial statements. The Braam and Beest model is a thirty-three-quality index based on the conceptual framework. This latter approach was adopted as a proxy for financial reporting quality for purposes of this current contribution.

Accounting Ethics

In the contemporary global business environment, the success and sustainability of the business organisation demand more than professionalism, big data acquisition and analysis, sophisticated technological inputs, and conventional MBA certificates from the best business schools. It is becoming crystal clear that in addition to these critical success attributes, modern business managers must be moral pundits. Moral pundits because business managers now have responsibilities and obligations to stakeholders of seemingly infinite latitude ranging from equity owners, creditors and suppliers, government, employees, customers, financial analysts, unions, and civil society to the society at large. Increasing demands from these diverse stakeholders will no doubt result in conflicts that are resolvable only through moral decisions in the domain of business ethics.

The mainstream workplace predicaments of the modern business manager in the form of micro-level moral mazes such as ethical dilemmas, racial discrimination, nepotism, corruption, and corporate malfeasances are becoming increasingly institutionalised in modern corporate organisations.

Ethics consist of the standard of behaviour to which we hold ourselves in our personal and professional lives. It establishes the levels of honesty, empathy, trustworthiness, and other virtues by which we hope to identify our behaviour and our public reputation (Byars & Stanberry, 2018). Ethics is a multidimensional concept with different perspectives ranging from individual or personal ethics, social ethics, religious ethics, and business or corporate ethics to professional ethics. For purposes of this discourse, professional ethics is the focus. The sociology of the profession defines a profession in the context of professionalism which connotes a certain degree of independence in society, members’ expertise is shaped by science and the professional work exemplifies a service ideal within a generalised responsibility to the public (Airaksinen, nd). Cruess, Johnston, and Cruess (2014:75) define a profession as an “occupation whose core element is work based upon the mastery of a complex body of knowledge and skills”. The International Ethics Standards Board for Accountants (IESBA, 2019) advanced five principles of ethics: integrity, objectivity, professional competence, and due care, confidentiality, and professional behaviour. These principles form the basis of the professional ethics for the current study.

Integrity simply means unity between beliefs and actions. It means trustworthiness and reputation for incorruptibility. Integrity according to IESBA (2019) requires an accountant to be straightforward and honest in all professional and business relations. Objectivity is defined as the mental attitude that permits the individual accountant or auditor to fulfill professional responsibilities without compromising judgment or ethical beliefs or yielding to the demands of others within and outside the organisation (Dawson & Reisch, 2016). Professional competence and due care require the accountant to act diligently and in accord with applicable professional and technical standards. Confidentiality means maintaining the secrecy of information acquired during a business or professional interaction. It is the obligation of an individual, in this case, the professional accountant to safeguard the information entrusted to him because of a business relationship. Professional behaviour requires the accountant to comply with extant laws and regulations and refrain from actions capable of bringing the profession to disrepute.

Diversity Management

Flood and Roman (1996) define diversity management as concerned with the management of increasing diversity issues that confront humankind in contemporary organizational and societal affairs. Cox (2001:3) defines diversity management as the “variation in social and cultural identities among people existing together in defined employment and market setting”.

Arguably, three distinct strands of diversity categories exist in extant literature: the socio-demographic diversity of ethnicity, religion, gender, age, disability, and workplace sexual discrimination; job-related diversity category of education, tenure, experience, and expertise; and lastly, the idiosyncratic diversity category of nationality and political ideology (Ozbilgin et al., 2014). While the first two diversity categories have received serious empirical consideration, the issue of idiosyncratic diversity has not enjoyed such empirical luxury. More importantly, to our knowledge extant literature is sparse on the moderating influence of idiosyncratic diversity on the relation between accounting ethics and financial reporting quality, except for the Labelle et al. (2010) case which studied the complementary influence of professional ethics, diversity management on financial reporting quality.

Idiosyncratic diversity management, with emphasis on national diversity management, is divided into two types of intra-national diversity management and cross-national diversity management. According to Tung (1993), intra-national diversity management is the ability of organisations to cope with an increasingly diverse workforce, concerning ethnic and gender diversity within a given nation. Tung (1993) opined that intra-national diversity management could also be referred to as the employment of different ethnic groups and women within a given nationality into professional and organisational ranks, hence bringing about diversity in management. On the other hand, cross-national diversity management also known as international diversity management has to do with managing a diverse workforce made up of citizens from different countries, including immigrants seeking employment in a foreign country. Cross-national diversity management involves the management of employees of expatriates’ origin and a host country national (Tung, 1993). Cox (1994) viewed diversity management from the perspective of planning and implementing organizational systems and practices designed to manage people to enhance the maximization of the benefits of diversity and reduce its limitations. Professionals with national heterogeneity will no doubt lead to improved creativity, innovation, global competitiveness, and knowledge transfer arising from a mix-match of experiences from different economies. The United States Agency for International Development [USAID] (2018) opined that cross-national diversity management entails the management of the workforce in an organization from different countries, noting that entities operating in a Cross-National context usually put in place diversity policies and programs to accommodate the differences in legislative and cultural dynamics of their subsidiaries’ hosts countries without prejudice to the provisions of the social norms and laws of their home base.

Review of Empirical Literature

Direct literature on the interactive influence of diversity management on the dynamics of accounting ethics-financial reporting quality is not only scarce in extant literature but also bourgeoning. However, the relationship between accounting ethics and financial reporting quality has enjoyed very robust empirical consideration both locally and internationally and, therefore, marks the foundation of the empirical review.

Accounting Ethics and Financial Reporting: Integrity and Financial Reporting Quality

The nexus between the ethical component of integrity and financial reporting quality has received considerable empirical consideration, even though the issue is still largely unresolved. Heese et al. (2023) posit that integrity oath-taking improves financial reporting quality by cutting down on accounting-based and real-activities earnings management. The survey research design was adopted by most of the studies and there is a predominantly positive and statistically significant relationship between the ethical principle of integrity and financial reporting quality (Eginiwin & Dike, 2014; Florah, 2018; Habib & Bhuiyan, 2015; Kertarajasa et al., 2019; and Mabil, 2019). Against the above backdrop, we hypothesise a significant relationship between integrity and financial reporting quality.

Objectivity and Financial Reporting Quality

Like the ethical principle of integrity, there appears to be a predominantly positive and statistically significant relationship between objectivity and financial reporting quality in extant literature (Edi & Enzelin, 2022; Eginiwin & Dike, 2014; Furiady & Kumia, 2015; Gamayuni, 2018; Idor et al., 2020). The statistically significant positive relationship shows that the accountants exhibit a more objective disposition that can elicit intersubjective communication. It shows that the actions of the accountants are independent of personal subjectivity because of biases of emotion and perceptions.

Therefore, it is expected that objectivity would significantly influence financial reporting quality.

Professional Competence and Due Care and Financial Reporting Quality

The relationship between professional competence and due care and financial reporting quality is positive and significant. (Abbott et al., 2016; Mustapha, 2018; Setiyawati & Iskandar, 2020). The result is however expected because the rigour of the training of the accountant is sufficient to enrich him with the knowledge and skills required to discharge his duties. According to Kiradoo (2020), professional and ethical values are relevant for reducing ethical issues that diminish the reputation and values of the accounting profession. In the same vein, Moridu (2023), in a descriptive study of the banking sector in West Java, there is consistent adherence to accounting principles in information generation by Accountants, which shows that the accountants deliver competent professional services. Against the above backdrop, we hypothesise a significant relationship between professional competence and financial reporting quality.

Confidentiality and Financial Reporting Quality

There appear to be two strands of literature on the relationship between the ethical principle of confidentiality and financial reporting quality. On the one hand, the relationship is positive and not statistically significant (Amisi, 2019; Mubaraq et al., 2019), which presupposes that there may be some level of illegal disclosure that amounts to a breach of professional duty. Breach of confidentiality is costly and damages the reputation and network. It is also important to note that the duty of confidentiality is not absolute according to the locus classicus case of Tournier v. National Provincial and Union Bank of England (1924), which provides circumstances where disclosure is not illegal. On the other hand, the relationship is positive and statistically significant which shows the absence or breach of duty of confidentiality (Aifuwa et al.,2018; Edi & Enzelin, 2022; Kukutia, 2019). Therefore, it is expected that confidentiality would significantly influence financial reporting quality.

Professional Behaviour and Financial Reporting Quality

The relationship between the ethical principle of professional behaviour is predominantly positive and statistically significant (Choi & Pae, 2011; Eginiwin & Dike 2014; Enofe et al., 2015; Enyi et al., 2019; Mahdavikhou & Khotanlou, 2011). The positive relationship shows strict compliance with relevant laws and regulations and did accountants did not participate in activities that are inimical to the reputation of the profession. Against the above backdrop, we hypothesise a significant relationship between professional behaviour and financial reporting quality.

Diversity Management and Financial Reporting Quality

The literature on diversity management and financial reporting quality is positive and statistically significant. Even though Omoro (2020) reported an insignificant relationship between diversity management, earnings quality and timeliness of financial reports. Schumann et al. (2023), investigated the relationship between diversity management and financial reporting quality and found evidence of a positive association between national diversity and financial reporting quality. Extant literature is replete with positive findings on intra-national diversity management and financial reporting quality (Hoang et al., 2015; Labelle et al., 2010) The relationship between cross-national diversity management and financial reporting quality is mixed. While some are positive and significant (Chung, 2017; Hashim, 2012; Lainez & Callao, 2000), there also exists a report of negative relationships (Alfiero et al., 2018).

3. METHODOLOGY

Theoretical framework and model specification

The study on the moderating influence of idiosyncratic diversity on the relationship between professional ethics and financial reporting quality employed a theoretical triangulation having combined the Pfeffer and Salancik (1978) resource dependency theory with the cognitive diversity hypothesis. We were however not unmindful of the limitation of incommensurability associated with theoretical triangulation. The relationship between accounting ethics and financial reporting quality has been a subject of different theoretic, ranging from the Donaldson and Davis (1989) stewardship theory, the Jensen and Meckling (1976) agency theory, the Meyer and Rowan (1977) institutional theory, and the Pfeffer and Salancik (1978) resource dependency theory. Our emphasis is on the resource dependency theory.

According to the resource dependency theory, the actions of actors (in the case of professional accountants) determine the outcome and the behavioural pattern of the organisation. Resources are critical to the success, growth, and sustainability of every organisation. Although agency theory predominates issues in financial reporting quality (Johnson et al., 1996; Dalton et al., 2007), the strength of the resource dependency theory is mostly in the area of how boards and other professionals help in resource acquisition thereby minimising the problem of dependence.

The training of the professional accountant presupposes a sound ethical culture. Accounting ethics is the application of an established code of conduct and the rule of best practices when an individual is expected to decide between various alternatives of moral principles. The Institute of Chartered Accountants of Nigeria (1978) and the International Federation of Accountants (2006) advanced six dimensions of ethics integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour. Against the backdrop of the theoretical exposition and extant literature, we expect a functional relationship between accounting ethics and the financial reporting quality of the form:

(6)

Financial Reporting Quality = f(Professional ethics)

Decomposing professional ethics based on the dimension of IFAC (2006), equation (i) is modified to integrate the dimensions as

(7)

Financial Reporting Quality = f (Integrity, Objectivity, Professional competence, Confidentiality, Professional behaviour)

Carter (1996) defined integrity as an open reflection of morals. The principle of integrity according to IFAC (2006) imposes a strict obligation on professional accountants to be candid and honest in their dealings. Extant literature has reported a positive and significant relationship between the professional principle of integrity and financial reporting quality (Florah, 2018; Ketarajasa et al., 2019; Mabil, 2019; Mubaraq et al., 2019). We presumptively expect a functional relationship between integrity and financial reporting quality. Thus:

Financial Reporting Quality = f(INTEGRITY-INTEG)

The objectivity principle imposes responsibility on the professional accountant against compromising their professional judgement as a result of a conflict of interest, external influence, or prejudice. Denziana (2015), Furiady and Kumia (2015), Gamayuni (2018), Idor et al., 2020), have all established a functional relationship between objectivity and financial reporting quality. Thus:

Financial Reporting Quality = f(OBJECTIVITY-OBJECT)

Professional competence and due care and financial and financial reporting quality have enjoyed a robust empirical consideration in extant literature (Abbott et al., 2016; Kusnadi et al., 2015; Mustapha, 2018; Setiyawatii, 2013; and Setiyawati & Iskandar, 2020). Thus, it is expected that:

(10)

Financial Reporting Quality = f (PROFESSIONAL COMPETENCE & DUE CARE-PROCOM

Confidentiality and financial reporting quality have been duly considered in extant literature (Aifuwa et al., 2018; Amisi, 2019; Kukutia, 2019, Mubaraq et al., 2019; and Musa, 2019). Thus, we presumptively expect that:

Financial Reporting Quality = f(CONFIDENTIALITY-CONFID)

The principle of Professional behaviour requires professionals to effectively manage interpersonal relationships, obey laws and avoid situations that prejudice the profession (Bakhtiari & Azimifar, 2013). Extant literature is replete with works on the relationship between professional behaviour and financial reporting quality (Choi & Pae, 2011; Enofe et al., 2015, Enyi et al., 2019; Im & Nam, 2019; Mahdavilou & Khoinlou, 2011). Therefore:

(12)

Financial Reporting Quality = f (PROFESSIONAL BEHAVIOUR-PROB)

The moderating influence of diversity management on the relationship between professional ethics and financial reporting quality is anchored on the cognitive diversity hypothesis which posits that multiple perspectives between members of the organisation, arising mainly from nationality in this context results in creative problem-solving. Against this backdrop,

(13)

financial reporting quality = f (Professional ethics * Idiosyncratic diversity management

The idiosyncratic diversity management relevant to the study is cross-national diversity management. According to the cognitive diversity hypothesis, broad thinking has become imperative because of the complexities and sophistication imposed by the globalisation of business. We expect professional accountants with diverse perspectives, and cross-national experiences to deliver more on accounting numbers and by extension, financial reporting quality. Therefore, equation (viii) is restated as

Financial Reporting Quality = f (Professional ethics * CROSS NATIONAL DIVERSITY-CROND)

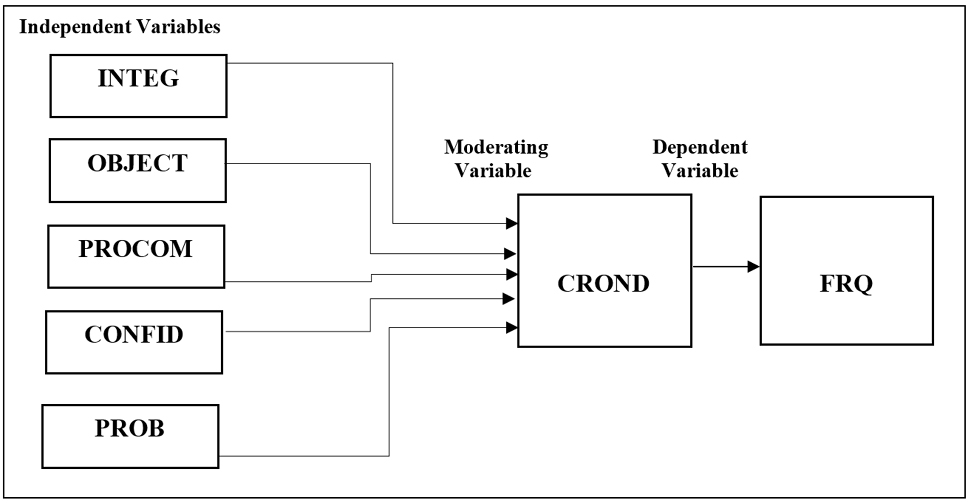

The schema arising from the theoretical framework is shown in Figure 1:

Figure 1. Schema on the moderating influence of diversity management on the relationship between accounting ethics and financial reporting quality

From the schema, the general functional form of the model, from the aggregation of equations (i) to (ix) is given as:

(15)

FRQ = f (INTEG, OBJECT, PROCOM, CONFID, PROB)

Integrating the moderating variable of cross-national diversity, equation (xiv) is transformed to:

(16)

FRQ = f(INTEG, INTEG*CROND, OBJECT, OBJECT*CROND, PROCOM, PROCOM*CROND, CONFID, CONFID*CROND, PROB, PROB*CROND)

The economic form of equation (xi) is given as:

(17)

FRQ = β1INTEG + β2INTEG*CROND + β3OBJECT + β4OBJECT*CROND + β5PROCOM + β6PROCOM*CROND + β7CONFID + β8CONFID*CROND + β9PROB + β10PROB*CROND + ∑

Where: FRQ is financial reporting quality, INTEG is the principle of integrity, CROND is cross-national diversity management, OBJECT is the principle of objectivity, PROCOM is the principle of professional competence and due care, CONFID is confidentiality, PROB is the principle of professional behaviour, β1 to β10 are the unknown coefficients of the explanatory and moderating variables and ∑ is the error term.

From extant literature and the theoretical framework, it is presumptively expected that if professional accountants are ethically conscious in an environment of cross-national diversity, financial reporting quality will be enhanced. Thus, β1, β2, β3…, β10 > 0.

Research Design

The study is driven by the positivist research philosophy and anchored on the deductive research strategy, which involves the operationalisation of concepts to aid the quantitative measurement of facts. We employed a combination of explanatory and descriptive research design. In the domain of explanatory design, the study helps to explain the relationship between the dependent, moderating, and dependent variables. The study is descriptive because it creates a setting for the respondents’ understanding of the concepts of ethics and diversity management. The study is a country-wide study, and the target population is the totality of accountants in the public and private sectors of the Nigerian economy. To circumvent the limitation of micro-numerosity of data arising from the unscientific determination of sample size, the Cochran (1977) sample size determination was adopted.

(18)

Sample size (n) = Z2P(1-P)/(e2)

The sample size is n, Z is the statistic corresponding to the level of confidence, P is the estimated proportion of the population attribute and e is the desired precision level. A sample size of three hundred and eighty-four respondents was scientifically established for the study. The respondents were randomly selected with equal opportunity to participate in the study. The primary data for the study were collected with the aid of a well-structured questionnaire using Google Forms. The questionnaire is divided into two parts. The first part (R1-R4; F1-F4, U1-U4; C1-C4, and T1-T4) is dedicated to measures of financial reporting quality based on the Braam and Beest (2013), IASB approach to financial reporting measurement. The second part (I1-I4; O1-O4; P1-P4 C1-C4; PB1-PB4) focuses on the measurement of ethical principles as advanced by the EISBA and the third part (IN1-IN4 & CN-CN4) addresses the measurement of diversity management.

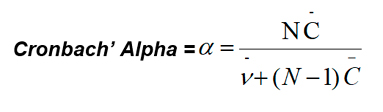

The research instrument was pilot-tested, to evaluate the research protocol and its validity. Content validity was achieved by the scrutiny of some experts to ensure the content of the instrument appropriately captures the study objectives. and the reliability of the instrument was established using the Cronbach’s Alpha test (19).

; is the average inter-item covariance among the items,

; is the average inter-item covariance among the items,  ; is the average variance, is Cronbach’s Alpha, and N is the number of items. The result of the test reported a composite Cronbach’s Alpha Statistic of 0.808 which suggests that the variables have a relatively high level of internal consistency. It shows that our multiple-question Likert scale survey is reliable. The speed of increase in variance was established using the variance inflation factor test given (20):

; is the average variance, is Cronbach’s Alpha, and N is the number of items. The result of the test reported a composite Cronbach’s Alpha Statistic of 0.808 which suggests that the variables have a relatively high level of internal consistency. It shows that our multiple-question Likert scale survey is reliable. The speed of increase in variance was established using the variance inflation factor test given (20):

VIF is the variance inflation factor, r2 is the coefficient of multiple determination between the variables, and 1 is a constant. Without collinearity, the VIF is equal to one (1). VIF above 10 according to Debbie et al. (2013), means the variables are highly colinear. The results in Table 4 show the absence of collinearity.

Table 1. Measurement of Variables

|

Variable |

Acronym |

Measurement |

Source |

Apriori Expectation |

|

Dependent: Financial Reporting Quality |

FRQ |

FRQ was measured based on IASB qualitative characteristics: Relevance (R1-R4); Faithful representation (F1-F5); Understandability (U1-U5); Comparability (C1-C5); and Timeliness (T1-T5). |

Braam & Beest (2013) |

Nil |

|

Independent (Accounting Ethics): Integrity |

INTEG |

Questions 11-14 |

IESBA |

+ |

|

Objectivity |

OBJECT |

Questions O1-O4 |

IESBA |

+ |

|

Professional Competence and Due Care |

PROFCOM |

Questions P1-P4 |

IESBA |

+ |

|

Confidentiality |

CONFID |

Questions C1-C4 |

IESBA |

+ |

|

Professional Behaviour |

PROFBEH |

Questions PB1-PB4 |

IESBA |

+ |

|

Moderating (Diversity Management): Intra-National Diversity Management |

INTNDM |

Questions IN1-IN4 |

Ibhadode (2021) |

+ |

|

Cross-National Diversity Management |

CRONDM |

Questions CN1-CN4 |

Igbadode (2021) |

+ |

4. ESTIMATION RESULTS AND DISCUSSION OF FINDINGS

Descriptive Analysis

Table 2. Descriptive Statistics of the Regression Variables

|

FRQ |

INTEG |

OBJECT |

PROFCOM |

CONFID |

PROFBEH |

INTNDM |

CRONDM |

|

|

Mean |

4.453875 |

4.312331 |

4.585366 |

4.624661 |

4.379404 |

4.250678 |

3.538618 |

4.338753 |

|

Median |

4.660000 |

4.250000 |

5.000000 |

5.000000 |

4.750000 |

4.500000 |

4.500000 |

4.750000 |

|

Maximum |

5.000000 |

5.000000 |

5.000000 |

5.000000 |

5.000000 |

5.000000 |

5.000000 |

5.000000 |

|

Minimum |

1.630000 |

2.000000 |

1.750000 |

1.750000 |

1.000000 |

1.000000 |

1.000000 |

1.000000 |

|

Std. Dev. |

0.480720 |

0.547205 |

0.655114 |

0.545213 |

0.888687 |

0.681296 |

1.537142 |

0.856014 |

|

Skewness |

–1.573748 |

–1.239930 |

–2.010526 |

–1.868908 |

–1.562979 |

–1.578315 |

–0.424605 |

–1.449371 |

|

Kurtosis |

6.425790 |

6.062867 |

7.187253 |

7.267974 |

4.747555 |

5.656383 |

1.468023 |

4.561581 |

|

Jarque-Bera |

332.7576 |

238.7869 |

518.1674 |

494.8730 |

197.1931 |

261.6929 |

47.17219 |

166.6840 |

|

Probability |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

|

– |

||||||||

|

Sum |

1643.480 |

1591.250 |

1692.000 |

1706.500 |

1616.000 |

1568.500 |

1305.750 |

1601.000 |

|

Sum Sq. Dev. |

85.04176 |

110.1914 |

157.9360 |

109.3906 |

290.6335 |

170.8123 |

869.5122 |

269.6558 |

|

Observations |

370 |

370 |

370 |

370 |

370 |

370 |

370 |

370 |

FRQ is financial reporting quality; INTEG is a proxy for the integrity of the accountant; OBJECT represents objectivity of the accountant; PROFCOM is professional competence; CONFID is a proxy for the confidentiality of the accountant; PROFBEH represents professional behaviour; INTNDM is a proxy for intra-national diversity management; & CRONDM represents a proxy for cross-national diversity management. The total observation is 369 respondents.

The results of the descriptive statistics are presented in Table 2. The mean financial reporting quality is 4.45387. The result represents high-quality financial reporting as perceived by the respondents. The integrity of the accountants reported a mean value of 4.312331, which implies that the respondents perceive the integrity of the accountants as very high. The independent variable of objectivity reported a mean value of 4.585366. The import of the result is that the respondents perceive objectivity as very high. The variable of professional competence reported a mean value of 4.624661. The confidence of the accountant reported a mean value of 4.379404. The mean value of professional behaviour is 4.250678. Intra-national and cross-national diversity management reported mean values of 3.538618 and 4.338753 respectively.

The Jarque-Bera statistics are relatively large with significant probability values. The dependent variable of financial reporting quality reported a JB statistic of 332.7576. The result shows that the variables are all normally distributed. In addition, the standard deviations of all the variables are relatively low and indicative of very low dispersion from the mean value of the variables.

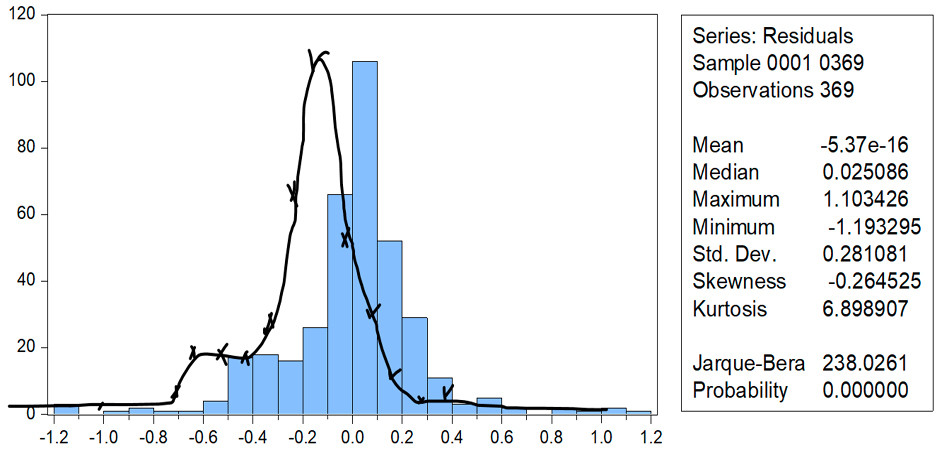

The regression variables are all negatively skewed, and the kurtosis is all over the benchmark of 3.0 The mean kurtosis and skewness are reported in the histogram normality test in Figure 2.

Figure 2. Result of the Histogram Normality test

The resulting histogram normality test is reported in Figure 4.1. The mean kurtosis of 6.898907 is positive and above the benchmark of 3. The result is indicative of leptokurtic distribution with a very highly picked histogram. The mean skewness of -0.264525 shows that the histogram is skewed leftward. The mean JB-statistic of 238.0261 and the significant probability value of 0.000000 is a confirmation of the normal distribution of the variables of regression.

Correlation Analysis

Table 3. Results of the Correlation Analysis

|

Covariance Analysis: Ordinary Date: 09/04/22 Time: 09:26 Sample: 0001 0369 Included observations: 369 |

||||||||

|

Correlation t-Statistic |

||||||||

|

Probability |

FRQ |

INTEG |

OBJECT |

PROFCOM |

CONFID |

PROFBEH |

INTNDM |

CRONDM |

|

FRQ |

1.000000 |

|||||||

|

– |

||||||||

|

– |

||||||||

|

INTEG |

0.485840 |

1.000000 |

||||||

|

10.64856 |

– |

|||||||

|

0.0000 |

– |

|||||||

|

OBJECT |

0.667172 |

0.576853 |

1.000000 |

|||||

|

17.15814 |

13.52872 |

– |

||||||

|

0.0000 |

0.0000 |

– |

||||||

|

PROFCOM |

0.632905 |

0.489072 |

0.703820 |

1.000000 |

||||

|

15.66037 |

10.74157 |

18.98036 |

– |

|||||

|

0.0000 |

0.0000 |

0.0000 |

– |

|||||

|

CONFID |

0.675118 |

0.309217 |

0.629177 |

0.614383 |

1.000000 |

|||

|

17.53183 |

6.229011 |

15.50737 |

14.91733 |

– |

||||

|

0.0000 |

0.0000 |

0.0000 |

0.0000 |

– |

||||

|

PROFBEH |

0.694456 |

0.464103 |

0.661979 |

0.574504 |

0.706178 |

1.000000 |

||

|

18.48952 |

10.03740 |

16.91968 |

13.44643 |

19.10700 |

– |

|||

|

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

– |

|||

|

INTNDM |

0.490726 |

–0.008725 |

0.413635 |

0.404409 |

0.551954 |

0.435738 |

1.000000 |

|

|

10.78942 |

–0.167154 |

8.703571 |

8.470965 |

12.68047 |

9.274281 |

– |

||

|

0.0000 |

0.8673 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

– |

||

|

CRONDM |

0.609794 |

0.243413 |

0.448004 |

0.459128 |

0.536303 |

0.570098 |

0.577574 |

1.000000 |

|

14.73956 |

4.807716 |

9.599788 |

9.900851 |

12.17272 |

13.29335 |

13.55408 |

– |

|

|

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

– |

|

Table 3 presents the results of the correlation analysis. The correlation coefficients between the dependent and the explanatory variables are positive, relatively weak and indicative of the absence of the problem of multicollinearity. The highest correlation coefficient is 0.703820, between professional competence and objectivity. The coefficient is below the benchmark of 0.80 which is a likelihood of the problem of multicollinearity. The result of the coefficient diagnosis of the variance inflation factor is a further confirmation of the absence of the problem of multicollinearity.

Table 4. Result of the Coefficient Diagnosis of Variance Inflation Factor

|

Variance Inflation Factors Date: 09/04/22 Time: 09:36 Sample: 0001 0369 Included observations: 369 |

|||

|

Variable |

Coefficient Variance |

Uncentered VIF |

Centered VIF |

|

C |

0.020649 |

94.60845 |

NA |

|

INTEG |

0.001370 |

118.5749 |

1.874007 |

|

OBJECT |

0.001493 |

146.7130 |

2.927003 |

|

PROFCOM |

0.001706 |

169.4781 |

2.317015 |

|

CONFID |

0.000736 |

67.32053 |

2.655573 |

|

PROFBEH |

0.001265 |

107.4448 |

2.683958 |

|

INTNDM |

0.000184 |

12.52084 |

1.983042 |

|

CRONDM |

0.000565 |

50.59223 |

1.890589 |

The result of the centered Variance Inflation factor is a further confirmation of the absence of the problem of multicollinearity in the regression variables. The values are relatively low and, on average, not substantially different from the benchmark of 1.0 and indicative of very low interrelation between the independent variables of the regression. Where multicollinearity is high, less reliable probability values are reported in terms of the relationship between the dependent and the explanatory variables.

Regression Diagnostics

Table 5. Results of the Regression Diagnostic Tests

|

TEST |

Probability |

Remarks |

|

Serial correlation |

0.0896 |

Absent |

|

Ramsey RESET |

0.2945 |

Well specified model |

|

Heteroskedasticity |

0.2000 |

Homoskedastic |

Table 5 presents the results of the classical assumption tests of regression analysis. The result of the Breusch-Godfrey test of serial correlation reported a probability value of 0.0896>P=0.05, which indicates the absence of the problem of serial correlation. The results corroborate the weak correlation coefficients reported in Table 3 and the results of the variance inflation factor in Table 4. The result of the Ramsey RESET test of model specification reported a probability value of 0.2495>P=0.05, which indicates that the regression model was well specified. The result of the Breusch-Pagan-Godfrey test of heteroskedasticity reported a probability value of 0.2000>P=0.05, which indicates the presence of homoscedastic residuals.

Analysis of the Regression Results

Table 6. Results of the Regression Analysis

|

VARIABLE |

COLUMN 1 |

COLUMN 2 |

COLUMN 3 |

|

CONSTANT |

1.4457 |

1,787259 |

1.575932 |

|

(9.629342) |

(11.41150) |

(10.526311) |

|

|

INTEG |

1.105061 |

||

|

(2.890117)* |

|||

|

INTEG*CROND |

–0.006247 |

||

|

(-0.179172)** |

|||

|

INTEG*INTOND |

–0.107734 |

||

|

(-3.973609)** |

|||

|

OBJECT |

0.107202 |

||

|

(2.673071)* |

|||

|

OBJECT*CROND |

–0.073032 |

||

|

(-1.504916)** |

|||

|

OBJECT*INTOND |

0.046478 |

||

|

(1.385026)** |

|||

|

PROCOM |

0.139265 |

||

|

(3.229839)* |

|||

|

PROCOM*CROND |

0.051690 |

||

|

(1.467478)** |

|||

|

PROCOM*INTOND |

0.033490 |

||

|

(1.057187)** |

|||

|

CONFID |

0.140641 |

||

|

(5.111383)* |

|||

|

CONFID*CROND |

0.084376 |

||

|

(2.905515)** |

|||

|

CONFID*INTOND |

0.005528 |

||

|

(0.231325 )** |

|||

|

PROB |

0.189028 |

||

|

(5.249698)* |

|||

|

PROB*CROND |

0.024297 |

||

|

(0.668033)** |

|||

|

PROB*INTOND |

0.029580 |

||

|

(1.037328)** |

|||

|

R-squared |

0.617108 |

0.667084 |

0.654878 |

|

Adjusted R-squared |

0.611834 |

0.657784 |

0.645237 |

|

F-statistic |

117.0098 |

71.73458 |

67.93130 |

|

Prob(F-statistic) |

0.000000 |

0.000000 |

0.000000 |

|

Durbin-Watson |

1.642729 |

1.852775 |

1.875660 |

|

Observations |

370 |

370 |

370 |

FRQ is financial reporting quality; INTEG is a proxy for the integrity of the accountant; OBJECT represents objectivity of the accountant; PROFCOM is professional competence; CONFID is a proxy for the confidentiality of the accountant; PROFBEH represents professional behaviour; INTNDM is a proxy for intra-national diversity management; & CRONDM represents a proxy for cross-national diversity management. The total observation is 370 respondents. * and ** significance thresholds at 5 % and 10 %.

The results of the multivariate Ordinary Least Squares model employed to investigate the moderating effect of idiosyncratic diversity management on the relationship between accounting ethics and financial reporting quality are presented in Table 6. Column 1 is the result of the relationship between accounting ethics and financial reporting quality, Column 2 is the result of the moderating influence of cross-national diversity on the relationship between accounting ethics and financial reporting quality. Column three is the result of the moderating influence of intra-national diversity on the relationship between accounting ethics and financial reporting quality.

The adjusted coefficient of multiple determination of the relationship between accounting ethics and financial reporting quality is 0.611834 indicating that about 61 % of the systematic variation in financial reporting quality is accounted for by the explanatory variables of accounting ethics. The other two models show good explanatory power with adjusted coefficients of multiple determination of 67 % and 66 % respectively. The F-statics of 117.0098 and the significant probability value of P=0.000000>0.05 show the joint significance of the independent variables. The result negates the null hypothesis that the coefficients of the variables are all equal to zero and signifies a high predictive power of the model. The Durbin-Watson statistic of 1.642729 is not substantially different from the benchmark of 2.0 and is indicative of the absence of the problem of autocorrelation.

In tandem with our presumptive expectation, the relationship between the ethical principle of integrity and financial reporting quality is positive and statistically significant at the 5 % level, with a robust t-value of 2.890117 which is beyond the likelihood of chance. The accountants were perceived as honest and straightforward in their business relationships. The result corroborates the mean responses of 4.312331 in the descriptive analysis in Table 2. The finding is consistent with the predominant positive relationship reported in extant literature (Eginiwin & Dike, 2014; Florah, 2018; Habib & Bhuiyan, 2015; Kertarajasa et al., 2019; and Mabil, 2019). When we moderated the relationship with intra-national diversity and cross-national diversity, the result became negative and significant at the 10 % level which implies that heterogenous professional groups arising from different nationalities and cultural values betray the attributes of fair dealing and honesty. While the negative relationship may be counter-intuitive, it may not be unconnected with the misinterpretation of professional communication and negative cultural prejudices or stereotypically associated with a heterogeneous workforce.

The relationship between objectivity and financial reporting quality is positive and significant at the 5 % level., with a t-value of 2.673071. The result shows that accountants do not compromise professional judgment thereby increasing the quality of reporting. The result is in tandem with the positive relationship reported in prior studies (Eginiwin & Dike, 2014; Furiady & Kumia, 2015; Gamayuni, 2018; Idor et al., 2020). Moderating the relationship with cross-national and intra-national diversity presents a statistically significant result at the 10 % level, meaning that accountants from different nationalities, cultures, and ethnic backgrounds function together effectively to deliver quality reporting.

The result of the relationship between professional competence and due care is positive and significant at the 5 % level with a robust t-value of 3.229839. The result indicates that the accountants possess the requisite professional knowledge and skill to deliver on their duties and is consistent with extant literature (Abbott et al., 2016; Mustapha, 2018; Setiyawati & Iskandar, 2020). When the relationship was moderated with idiosyncratic diversity, the result was significant at the 10 % level and indicates that heterogeneous professionals from diverse nationalities will act diligently and in consonance with extant professional and technical standards.

The relationship between the ethical principle of confidentiality and financial reporting quality is positive and statistically significant at the 5 % level and implies that the accountants are not under any obligation to disclose information to third parties. The variable reported a t-value of 5.111383 and aligns with the positive relationship in extant literature (Aifuwa et al., 2018; Kukutia, 2019). The moderation of the relationship between confidentiality and financial reporting quality with cross-national and intra-national diversity management is positive and significant at the 10 % level and implies that heterogeneous professionals of different nationalities and cultures respect the confidentiality of information acquired from business relationships.

Professional behaviour reported a coefficient of 0.189028 and a t-value of 5.249698 at the 5 % significance level which implies that an increase in the level of professional behaviour will increase financial reporting quality by 2 %. The result of the significant relationship is consistent with extant literature (Choi & Pae, 2011; Eginiwin & Dike, 2014; Enofe et al., 2015; Enyi et al., 2019; Mahdavikhou & Khotanlou, 2011). The moderation of the relationship with cross-national and intra-national diversity management was significant at the 10 % level.

5. CONCLUSION AND RECOMMENDATIONS

Extant literature is replete with studies on the relationship between accounting ethics and financial reporting quality. Empirical findings, both local and international suggest a significant relationship between accounting ethics and financial reporting quality (Choi & Pae, 2011; Eginiwin & Dike, 2014; Abbott et al., 2016; Gamayuni, 2018; Idor et al., 2020; Kertarajasa et al., 2019; and Mabil, 2019).

However, the moderating influence of idiosyncratic diversity (with emphasis on cross-national diversity and intra-national diversity) on the relationship between accounting ethics and financial reporting quality is not only unclear but relatively sparse and forms the contribution of the current study. Advancing a case for heterogeneous professionals against the backdrop of the complexities and sophistication of business activities occasioned by globalization and other contemporary national boundary-shrinking activities is long overdue. To our knowledge, the closest to such a study is Labelle et al. (2009) complementary consideration of business ethics, diversity management, and financial reporting quality, where we drew the current inspiration.

The findings of the study start by further validating the significant relationship between accounting ethics and financial reporting quality and further advance a significant moderating influence of idiosyncratic diversity on the relationship between accounting ethics and financial reporting quality. We have been able to establish that in addition to the quality financial reporting implications of accounting ethics, the presence of heterogeneous professionals, drawing inspirations and skills from different backgrounds, economies, and corporate cultures is more likely to deliver quality financial reporting.

Consequent to the above, we offer two recommendations. The positive relationship between accounting ethics and financial reporting quality calls for strict compliance with professional ethical principles. Secondly, accounting professionals in any organization should be a mixture of nationalities against the backdrop of the significant moderating influence of idiosyncratic diversity on the relationship between accounting ethics and financial reporting quality. The pool of cultural diver professionals will help the organization attract and retain the best hands in the industry which would guarantee personal growth and development.

REFERENCES

, , , & (2016). Internal audit quality and financial reporting quality: The joint importance of independence and competence. Journal of Accounting Research, 54(1), 3-40.

, & (2014). Factors influencing the quality of financial reporting and its implication on Good Corporate Governance (Research on local government in Indonesia). International Journal of Business, Economics, and Law, 5(1), 111-121.

, , & (2018). Ethical accounting practices and financial reporting quality. EPRA International Journal of Multidisciplinary Research. 4 (12), 31-44.

, , , , , & (2023). Corporate ethics and financial reporting quality: A thematic analysis from Accountants’ perspectives. In: Mansour, N., Bujosa Vadell, L.M. (eds) Finance, Accounting and Law in the Digital Age. Contributions to Management Science. Springer, Cham. https://doi.org/10.1007/978-3-031-27296-7_8

(nd). Institutional issues involving ethics and justice https://www.eolss.net.

, , , & (2018). The effect of national cultural differences of board members on integrated reporting. Corporate Board: Role, Duties & Composition,14(1), 7-21.

(2019). Accounting ethical practices and financial reporting quality of manufacturing companies in Uganda, a case study of Mukwano group of companies. [Unpublished Dissertation] submitted to the College of Economics and Management, Kampala International, University.

& (2013). Impact of professional ethics on financial reporting quality. Advances in Environmental Biology, 7(10), 2862-2866

(1998). Comments. Journal of Business and Economic Statistics, 5(1967):190.

(2004). Discussion on a framework for the analysis of Firm risk communication. The International Journal of Accounting, 39(3):289-295.

& (2013). Conceptually-based financial reporting quality assessment: An empirical analysis on quality differences between UK annual reports and US 10-K reports. NiCE Working Paper 13-106. (6) (PDF) IFRS Adoption and Financial Reporting Quality: IASB Qualitative Characteristics Approach. Available from: https://www.researchgate.net/publication/329012123_IFRS_Adoption_and_Financial_Reporting_Quality_IASB_Qualitative_Characteristics_Approach [accessed Sep 06 2021].

, & (2018). Business Ethics. Houston: Rice University.

, , & (2017). Detecting earnings management investigation on different models measuring earnings management for emerging Eastern Europe countries. International Journal of Research. 5(11):222-259

Companies and Allied Matters Act.(2020). Federal Government of Nigeria Printers, Abuja.

(1996). Integrity. New York: HarperCollins.

Chartered Financial Analyst Institute (2020). Financial reporting quality. cfa institute.org.

(1977). Sampling techniques, Third Edition, New York: John Wiley & Sons.

& (2011). Business ethics and financial reporting quality: Evidence from Korea. Journal of Business Ethics, 103, 403-427.

(2001). Creating the multicultural organization. A strategy for capturing the diversity. San Fransisco, USA: Jossey-Bass.

(1994). Cultural diversity in organisations: Theory research and practice. San Fransisco:Berret-Koehler.

(2017). Do differences in national cultures affect cross-country financial statement comparability under IFRS? PhD (Doctor of Philosophy) thesis, University of Iowa.

, , & (2014). Profession: A working definition for medical education. Teaching and Learning Medicine: An International Journal, 16(1), 74-76.

, , , & (2007). Agency theory and its mitigation. In A. Brief, & J. Walsh (Eds.), Academy of Management Annals,1: 1-64. Mahwah, NJ: Lawrence Erlbaum. Dalt

(1986). Accounting numbers as market valuation substitutes: A study of management buyouts of public stockholders. The Accounting Review, 61(3), 400-420.

, & (2016). The objectivity of the accountant’s judgement: A replication and extension. Https:// the schorlashipecu.edu.

, , & (2013). Robust VIF regression with application to variable Selection in large data sets. The Annals of Applied Statistics, 7,319-341.

, , & (1995). Detecting earnings management. The Accounting Review, 70(2), 193-225.

, & (1994). Debt covenant violation and manipulation of accruals. Journal of Accounting and Economics, 17(1-2), 145-176.

(2015). The effect of audit committee quality and internal auditor objectivity on the prevention of fraudulent financial reporting and the impact on financial reporting quality (a survey on state-owned companies in Indonesia). International Journal of Monetary Economics and Finance, 8(2), 213-227.

, & (1989) CEO governance and shareholder returns: Agency theory or stewardship theory. Paper Presented at the Annual Meeting of the Academy of Management.

, & (2022). Analysing the effect of accounting ethics towards the effect of financial reports. Journal of Accounting, Finance and Auditing Studies, 8(2), 36-53.

& (2014). Accounting ethics and the quality of financial reporting: A survey of some selected oil exploration and producing companies in Nigeria. IOSR Journal of Business and Management, 16(7), 26-36.

, , & (2015). The effect of accounting ethics on the quality of financial reports of Nigerian firms. Research Journal of Finance and Accounting, 6(12), 123-130.

, , , & (2019). Ethical issues and faithful representtion of financial reports of quoted companies in Nigeria. International Journal of Business and Management Review, 7(3):1-10.

(2018). Safeguarding of integrity in financial reporting and performance of public TVET institutions in Nyanza region, Kenya. International Journal of Advanced Research, 6(8), 768-773.

, & (1996). Diversity management: Tripple-loop learning. Chichester: Willey.

& (2015). The effect of work experiences, competency, motivation, accountability, and objectivity towards audit quality. Social and Behavioral Sciences, 211, 328-335.

(2018). The effect of internal auditor competence and objectivity, and management support on the effectiveness of internal audit function and financial reporting quality implications at local government. International Journal of Economic Policy in Emerging Economies, 11(3), 248-261.

& (2015). Problem directors on the audit committee and financial reporting quality. Accounting and Business Research. 46(2): 121-144. DOI:10.1080/00014788.2015.1039477.

, , , & (1998). When groups consist of multiple nationalities: Towards a new understanding of the implications. Organization Studies 19(2), 181–205.

(2012). The influence of culture on financial reporting quality in Malaysia. Asian Social Science, 8(13), 192-200.

(1985). The effect of bonus schemes on accounting decisions. Journal of Accounting and Economics, 7, 85-107.

, , & (2023). Can integrity pledges reduce financial reporting? The CLS Blue Sky Blog-https//www.dbluesky-law.columbia.edu

, , & (2015). The effect of board diversity on earnings quality: An Empirical Study of Listed Firms in Vietnam. Australian Accounting Review, 27(2), 220-232.

, & (2017). Financial reporting quality: A literature review. International Journal of Business, Management and Commerce, 2(2), 1-15.

Institute of Chartered Accountants of Nigeria. (1998). (Dimensions of ethics). Lagos, Nigeria.

International Ethics Standards Board for Accountants. (2019). (Dimensions of ethics). New York City, United States of America.

International Federation of Accountants Committee. (2006). (Code of ethics). New York City, United States of America.

, , & (2020). Empirical examination of accounting professional etiquettes and quality of financial statements disclosure. IOSR Journal of Economics and Finance, 11(2), 1-10.

(2021). Accounting ethics, diversity management and financial reporting quality [Unpublished doctoral dissertation]. Department of Accounting, Faculty of Management Sciences, University of Benin, Benin City, Nigeria.

& (2019). Does ethical behavior of management influence financial reporting quality? Sustainability, 11(5765), 1-16.

, & (1976). Theory of the firm: managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 3, 305–360.

, , & 1996. Boards of directors: A review and research agenda. Journal of Management, 22: 409-438.

(1991). Earnings management during import relief investigation, Journal of Accounting Research, 29(2), 193-228.

(2020). Ethics in accounting: Analysis of current financial factors and roles of accountants. International Journal of Management, 11(2), 241-247.

, & (2022). Investigation of accounting ethics effect on financial reporting quality and decision-making. Evidence from Kabul-based logistic corporations. International Journal of Management Accounting and Economics, 8(3), 21.

, , & (2019). The effect of competence, experience, independence, due professional care, and auditor integrity on audit quality with auditor ethics as a moderating variable. Journal of Accounting, Finance and Auditing Studies, 5(1), 80-99.

(2019). Effects of ethical accounting practices on financial reporting quality: A survey of listed firms in Kenya. Masters of Business Administration Thesis, Kabara University, KABU Repository, http://10.1.130.140:8080/xmlui/handle/123456789/270.

, , , & (2015). Audit committees and financial reporting quality in Singapore. Journal of Business Ethics. 139, 197-214. DOI 10.1007/s10551-015-2679-0

, , & (2010). Ethics, diversity management, and financial reporting quality. Journal of Business Ethics, 93, 335-353.

&(2000). The effect of accounting diversity on international financial analysis: Empirical evidence. The International Journal of Accounting, 35(1), 65-83.

(). Investigating effects of accounting ethics on quality of financial reporting of an organization: Case of selected commercial Banks in South Sudan. Mediterranean Journal of Social Sciences, 10(1), 177-191.

& (2011). The impact of professional ethics on financial reporting quality. Australian Journal of Basic and Applied Sciences, 5(11), 2092-2096.

, & (1977). Institutionalized organizations: Formal structure as myth and ceremony. American Journal of Sociology, 83, 340–363.

(2023). Impact of financial statement quality on investment decision making. The ES Accounting and Finance, 1(03), 169-175.

, , & (2019). Ethical accounting practices and financial reporting quality: Evidence from listed firms in Nigeria. Accounting and Taxation Review, 3(2), 97-110.

(2019). Professionalism and ethics of accounting in financial reporting: An overview of Nigerian scenario. European Scientific Journal, 15(25), 224-238.

(2018). Professionalism, staff competency and financial reporting quality in the public sector. Malaysian Management Journal, 22, 67-86.

(2020). Top management team diversity and the moderating effect of discretionary accounting choices on financial reporting quality among commercial state corporations in Kenya. Journal of Accounting Business and Finance Research, 8(2), 79-89.

, , , & (2014). The business case for diversity management iumv.esrc.acc.uk.

, , & (2000). Detecting earnings management using cross-sectional accrual models. Accounting and Business Research, 30(4), 313-326.

, & (1978). The external control of organisations: A resource dependence perspective. New York: Harper & Row.

, , , & (2023). Does top management team diversity affect accounting quality? Empirical evidence from Germany.Journal of Management and Governance, 27(3), 1-39. https://doi.org/10.1007/s10997-23-09668-7

, & 1978. The external control of organizations: A resource dependence perspective. New York: Harper & Row

(2013). The effect of internal accountants’ competence, managers’ commitment to organizations and the implementation of the internal control system on the quality of financial reporting. International Journal of Business and Management Invention, 2(11), 19-27.

& (2020). Importance of internal accountants’ competence in shaping good quality financial reporting in Local Governments in Indonesia. International Journal of Innovation, Creativity and Change, 11(1), 20-37.

(1964). Small groups. San Francisco, USA: Chandler Publishing Co.

(1993). Managing cross-national and intra-national diversity. Human Resource Management, 32(4), 461-477.

United States Agency for International Development [USAID] (2018). Workplace diversity management. Local Enterprise Support Project.