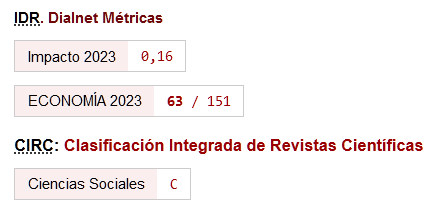

GARCH Family Models vs EWMA: Which is the Best Model to Forecast Volatility of the Moroccan Stock Exchange Market?

DOI:

https://doi.org/10.46661/revmetodoscuanteconempresa.2662Keywords:

volatility forecasting, volatility modeling, stylized facts, GARCH family models, EWMA, pronósticos de volatilidad, modelización de volatilidad, hechos estilizados, modelos de la familia GARCHAbstract

Nowadays, modeling and forecasting the volatility of stock markets have become central to the practice of risk management; they have become one of the major topics in financial econometrics and they are principally and continuously used in the pricing of financial assets and the Value at Risk, as well as the pricing of options and derivatives. The aim of this article is to compare the GARCH (Generalised Auto Regressive Conditional Heteroskedasticity) family models —GARCH (1.1), GJR-GARCH, PGARCH, EGARCH, and IGARCH— with the EWMA (Exponentially Weighed Moving Average) model in the hope of finding the best model to forecast the volatility of the Moroccan stock-market index MADEX. We use daily returns covering the period between 01/04/1993 and 30/08/2016. We find that the asymmetric model IGARCH following a normal error distribution yields the best forecasting performance results and therefore, surpasses the EWMA model. Our results could have application in the risk management in Morocco, as well as leading to a better understanding of the Moroccan stock-exchange volatility dynamics, especially with the lack of previous similar studies.

Downloads

References

Akgiray V., (1989). Conditional heteroscedasticity in time series of stock returns: Evidence and forecasts. Journal of Business, 62(1), 55-80.

Black, F. (1976). Studies of stock price volatility changes. In: Proceedings of the 1976 Meeting of the Business and Economic Statistics Section (pp. 171-181), Washington: American Statistical Association.

Bollerslev, T. (1986). Generalized Autoregressive Conditional Heteroskedasticity. Journal of Econometrics, 31(3), 307–327.

Bollerslev, T.; Chou, R.Y. and Kroner, K.F. (1992). ARCH Modeling in Finance: A Review of Theory and Empirical Evidence. Journal of Econometrics, 52(1-2), 5-59.

Bollerslev, T.; Engle, R.F. and Nelson, D.B. (1994). ARCH model. In: R.F. Engle and D.L. McFadden (eds.), Handbook of Econometrics, Volume IV (pp. 2961-3031), New York: Elsevier Science.

Brailsford, T.J. and Faff, R.W. (1996). An Evaluation of Volatility Forecasting Techniques. Journal of Banking and Finance, 20(3), 419-438.

Brooks, C. (2008). Modelling volatility and correlation. In: C. Brooks, Introductory Econometrics for Finance (pp. 379-450), New York: Cambridge University Press.

Carroll, R. and Kearney, C. (2009). GARCH Modeling of Stock Market Volatility. In: G.N. Gregoriou (ed.), Stock Market Volatility (pp. 71-90), New York: Chapman and Hall.

Ding, Z.; Granger, C.W.J. and Engle, R.F. (1993). A long memory property of stock market returns and a new model. Journal of Empirical Finance, 1, 83-106.

Engle, R.F. (1982). Autoregressive Conditional Heteroskedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica, 50(4), 987-1007.

Engle, R.F. and Bollerslev, T. (1986). Modelling the Persistence of Conditional Variances. Econometric Reviews, 5(1), 1-50.

Engle, R.F. and Ng, V. (1993). Measuring and testing the impact of news on volatility. Journal of Finance, 48(5), 1749-1778.

Engle, R.F. and Patton, A.J. (2001). What good is a volatility model? Quantitative Finance, 1, 237-245.

Fama, E. (1965). The Behavior of Stock Market Prices. Journal of Business, 38(1), 34-105.

Franses, P.H. and Van Dijk, D. (1996). Forecasting Stock Market Volatility Using (Non-Linear) GARCH Models. Journal of Forecasting, 15(3), 229-235.

Glosten, L.R.; Jagannathan, R. and Runkle, D.E. (1993). On the Relation between Expected Value and the Volatility of the Nominal Excess Return on Stocks. Journal of Finance, 48(5), 1779-1801.

Ding, J. and Meade, N. (2010). Forecasting accuracy of stochastic volatility, GARCH and EWMA models under different volatility scenarios. Applied Financial Economics, 20(10), 771-783.

Lupu, R. and Lupu, I. (2007). Testing for heteroskedasticity on the Bucharest Stock Exchange. Romanian Economic Journal, 11(23), 19-28.

Mandelbrot, B. (1963). The variation of certain speculative prices. Journal of Business, 36(4), 394-419.

Miron, D. and Tudor, C. (2010). Asymmetric Conditional Volatility Models: Empirical Estimation and Comparison of Forecasting Accuracy. Romanian Journal of Economic Forecasting, 13(3), 74-92.

Nelson, D.B. (1991). Conditional Heteroskedasticity in Asset Returns: A New Approach. Econometrica, 59(2), 347–370.

Pagan, A. and Schwert, G.W. (1990). Alternative Models for Common Stock Volatilities. Journal of Econometrics, 45(1), 267-290.

Poon, S.-H. and Granger, C.W.J. (2003). Forecasting Volatility in Financial Markets: A Review. Journal of Economic Literature, 41(2), 478-539.

Taylor, S.J. (1986). Modelling Financial Time Series. Chichester: John Wiley & Sons.

Thomas, S. and Mitchell, H. (2005). GARCH Modeling of High-Frequency Volatility in Australia’s National Electricity Market. Discussion Paper. Melbourne Centre for Financial Studies

West, K.D. and Cho, D. (1994). The Predictive Accuracy of Several Models of Exchange Rate Volatility. Journal of Econometrics, 69, 367-391.

Zakoian, J.-M. (1994). Threshold heteroskedastic models. Journal of Economic Dynamics and Control, 18, 931-955.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2018 Journal of Quantitative Methods for Economics and Business Administration

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Submission of manuscripts implies that the work described has not been published before (except in the form of an abstract or as part of thesis), that it is not under consideration for publication elsewhere and that, in case of acceptance, the authors agree to automatic transfer of the copyright to the Journal for its publication and dissemination. Authors retain the authors' right to use and share the article according to a personal or instutional use or scholarly sharing purposes; in addition, they retain patent, trademark and other intellectual property rights (including research data).

All the articles are published in the Journal under the Creative Commons license CC-BY-SA (Attribution-ShareAlike). It is allowed a commercial use of the work (always including the author attribution) and other derivative works, which must be released under the same license as the original work.

Up to Volume 21, this Journal has been licensing the articles under the Creative Commons license CC-BY-SA 3.0 ES. Starting from Volume 22, the Creative Commons license CC-BY-SA 4.0 is used.