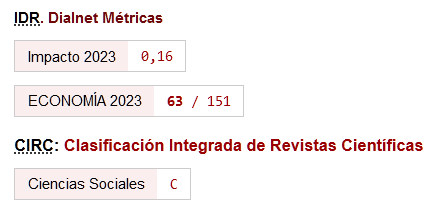

Volatility Linkages between Agricultural Commodity Prices, Oil Prices and Real USD Exchange Rate

DOI:

https://doi.org/10.46661/revmetodoscuanteconempresa.2700Keywords:

Oil prices, exchange rates, agricultural commodity prices, panel cointegration, FMOLS–DOLS estimators, Granger causality, precios del aceite, tipos de cambio, precios de productos agrícolas, cointegración de panel, FMOLS–DOLS, causalidad de GrangerAbstract

This study examines the dynamic nexus betwixt oil prices, twenty-two world agricultural commodity prices and given the evolution of the relative strength of the US dollar in a panel setting. We use panel cointegration and Panel Granger causality methods for a panel of twenty-two agricultural products based on annual observations ranging from 1980 to 2015. The empirical results provide a strong evidence of long-term relationship between Agricultural Commodity Prices, Oil Prices and Real USD Exchange Rate. Contrary to the findings of many studies in the literature that report neutrality of agricultural prices to oil price changes, we find strong support of bi-directional causal linkages among Agricultural Commodity Prices, Oil Prices and Real USD Exchange Rate. The long-run causality analysis thereby implies that the oil prices and the dollar have a predictive power to forecast the agricultural prices, which could be a good tool to prioritize the allocation of resources across industries to ensure agricultural scenario in general and economic outcomes.

Downloads

References

Abbott, P. C.; Hurt, C. and Tyner, W. E. (2008). What's driving food prices? Farm Foundation Issue Report, July 2008.

Akaike, H. (1974). A new look at the statistical identification model. IEEE Transactions on Automatic Control, 19, 716-723.

Akram Q. F. (2009). Commodity prices, interest rates and the dollar. Energy Economics, 31: 838-851.

Baffes, J. (2007). Oil spills on other commodities. Resources Policy, 32, 126-134.

Baffes, J. (2010). More on the energy/non-energy price link. Applied Economic Letters, 17, 1555-1558.

Baffes, J. and Haniotis, T. (2010). Placing the 2006/08 commodity price boom into perspective. World Bank Policy Research Paper No. 5371.

Campiche, J. L.; Bryant, H. L.; Richardson, J. W. and Outlaw, J. L. (2007): Examining the evolving correspondence between petroleum prices and agricultural commodity prices. 2007 Annual Meeting, July 29-August 1, 2007. Portland, Oregon: American Agricultural Economics Association.

Cha, K. S. and Bae, J. H. (2011). Dynamic impacts of high oil prices on the bioethanol and feedstock markets. Energy Policy, 39, 753-760.

Chen, S.-T.; Kou, H.-I. and Chen, C.-C. (2010a). Modeling the relationship between the oil price and global food prices? Applied Energy, 87(8), 2517-2525.

Chen, Y.-C.; Rogoff, K. S. and Rossi, B. (2010b). Can exchange rates forecast commodity prices? The Quarterly Journal of Economics, 125(3), 1145-1194.

Ciaian, P. and Kancs, d'A. (2011a). Food, energy and environment: Is bioenergy the missing link. Food Policy, 36, 571-580.

Ciaian, P. and Kancs, d'A. (2011b). Interdependencies in the energy–bioenergy–food price systems: A cointegration analysis. Resource and Energy Economics, 33, 326-348.

Esmaeili, A. and Shokoohi, Z. (2011). Assessing the effect of oil price on world food prices: Application of principal component analysis. Energy Policy, 39, 1022-1025.

Gilbert, C.L. (2010). How to understand high food prices. Journal of Agricultural Economics, 61, 398-425.

Harri, A.; Nalley, L. and Hudson, D. (2009). The relationship between oil, exchange rates, and commodity prices. Journal of Agricultural and Applied Economics, 41, 501-510.

He, Y.; Wang, S. and Lai, K.K. (2010). Global economic activity and crude oil prices: A cointegration analysis. Energy Economics, 32, 868-876.

Headey, D. and Fan, S. (2008). Anatomy of a crisis: The causes and consequences of surging food prices. Agricultural Economics, 39, 375-391.

Im, K.S.; Pesaran, M.H. and Shin, Y. (2003): Testing for unit roots in heterogeneous panels. Journal of Econometrics, 115, 53-74.

Kaltalioglu, M. and Soytas, U. (2009). Price transmission between world food, agricultural raw material, and oil prices. 2009 Proceedings of Global Business and Technology Association (GBATA), July 7-11, 2009. Prague: Global Business and Technology Association, pp. 596-603.

Kristoufek, L.; Janda, K. and Zilberman, D. (2012). Correlations between biofuels and related commodities before and during the food crisis: A taxonomy perspective. Energy Economics, 34, 1380-1391.

Levin, A.; Lin, C.F. and Chu, C.-H.J. (2002). Unit root tests in panel data: asymptotic and finite-sample Properties. Journal of Econometrics, 108, 1-24

Mark, N.C. and Sul, D. (2003). Cointegration vector estimation by panel DOLS and long-run money demand. Oxford Bulletin of Economics and Statistics, 65, 665-680.

Mutuc, M.; Pan, S. and Hudson, D. (2010). Response of cotton to oil price shocks. Agricultural Economic Review, 12, 40-49.

Natanelov, V.; Alam, M.J.; McKenzie, A.M. and Huylenbroeck, G.V. (2011). Is there co-movement of agricultural commodities futures prices and crude oil? Energy Policy, 39, 4971-4984.

Nazlioglu, S. and Soytas, U. (2011). World oil prices and agricultural commodity prices: Evidence from an emerging market. Energy Economics, 33, 488-496.

Nazlioglu, S. and Soytas, U. (2012). Oil price, agricultural commodity prices, and the dollar: A panel cointegration and causality analysis. Energy Economics, 34, 1098-1104.

Pedroni, P. (1999). Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bulletin of Economics and Statistics, 61, 653-678.

Pedroni, P. (2001a). Fully modified OLS for heterogeneous cointegrated panels. In Baltagi, B.H. (ed.): Nonstationary Panels, Panel Cointegration, and Dynamic Panels (Advances in Econometrics, Volume 15). New York: Emerald Group Publishing (pp. 93-130).

Pedroni, P. (2001b). Purchasing power parity tests in cointegrated panels. Review of Economics and Statistics, 83, 727-731.

Pedroni, P. (2004). Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric Theory, 20, 597-625.

Reboredo, J.C. (2012). Do food and oil prices co-move? Energy Policy, 49, 456-467.

Rosa, F. and Vasciaveo, M. (2012). Volatility in US and Italian agricultural markets, interactions and policy evaluation. 123rd EAAE Seminar “Price Volatility and Farm Income Stabilisation”, February 23-24, 2012. Dublin: European Association of Agricultural Economists.

Saghaian, S. H. (2010). The impact of the oil sector on commodity prices: Correlation or causation? Journal of Agricultural and Applied Economics, 42, 477-485.

Schuh, G. E. (1974). The exchange rate and U.S. agriculture. American Journal of Agricultural Economics, 56, 1-13.

Schwarz, G. (1978). Estimating the dimension of a model. Annals of Statistics, 6, 461-464.

Serra, T. and Zilberman, D. (2013). Biofuel-related price transmission literature: A review. Energy Economics, 37, 141-151.

Wixson, S. and Katchova, A.L. (2012). Price Asymmetric Relationships in Commodity and Energy Markets. 123rd EAAE Seminar “Price Volatility and Farm Income Stabilisation”, February 23-24, 2012. Dublin: European Association of Agricultural Economists.

Yu, T.-H.; Bessler, D.A. and Fuller, S. (2006). Cointegration and Causality Analysis of World Vegetable Oil and Crude Oil Prices. 2006 Annual Meeting, July 23-26, 2006, Long Beach, California: American Agricultural Economics Association.

Zhang, Z.; Lohr, L.; Escalante, C. and Wetzstein, M. (2010). Food versus fuel: What do prices tell us? Energy Policy, 38: 445-451.

Zhang, Q. and Reed, M. (2008). Examining the impact of the world crude oil price on China's agricultural commodity prices: The case of corn, soybean, and pork. 2008 Annual Meeting, February 2-5, 2008. Dallas, Texas: Southern Agricultural Economics Association.

Zilberman, D.; Hochman, G.; Rajagopal, D.; Sexton, S. and Timilsina, G. (2012). The impact of biofuels on commodity food prices: assessment of findings. American Journal of Agricultural Economics, 95, 275-281.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2018 Journal of Quantitative Methods for Economics and Business Administration

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Submission of manuscripts implies that the work described has not been published before (except in the form of an abstract or as part of thesis), that it is not under consideration for publication elsewhere and that, in case of acceptance, the authors agree to automatic transfer of the copyright to the Journal for its publication and dissemination. Authors retain the authors' right to use and share the article according to a personal or instutional use or scholarly sharing purposes; in addition, they retain patent, trademark and other intellectual property rights (including research data).

All the articles are published in the Journal under the Creative Commons license CC-BY-SA (Attribution-ShareAlike). It is allowed a commercial use of the work (always including the author attribution) and other derivative works, which must be released under the same license as the original work.

Up to Volume 21, this Journal has been licensing the articles under the Creative Commons license CC-BY-SA 3.0 ES. Starting from Volume 22, the Creative Commons license CC-BY-SA 4.0 is used.