The Impact of Oil Price Fluctuations on Bank Lending Power in Iran: An Application of GMM Approach

DOI:

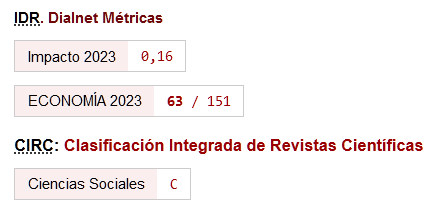

https://doi.org/10.46661/revmetodoscuanteconempresa.5537Keywords:

oil shock, bank lending power, Iranian economy, Generalized Method of Moments (GMM)Abstract

The abundance of oil resources and the dependence of the state budget on crude oil exports have exposed Iran's single-product economy to oil price fluctuations and its consequences. On the other hand, according to the country's financial system and its being bank-centric, one of the sectors that are constantly affected by oil price fluctuations is the banking system and its performance. To this end, the present study investigated the impact of oil price fluctuations on lending power of specialized banks in Iran using seasonal data from 1999 to 2018 using by Generalized Method of Moments (GMM). The results of this study indicate that during the period under review, oil price fluctuations has been a negative and significant effect (coefficient of -0.01) on the credit growth of specialized banks. In addition, GDP growth and inflation have been, respectively, a positive and negative effect (coefficients of 0.09 and -0.09) on the lending power of specialized banks during the period under review.

Downloads

References

Alodayni, S. (2016). Oil Prices, Credit Risks in Banking Systems, and Macro-Financial Linkages across GCC Oil Exporters. International Journal of Financial Studies, 4(4), 1-14.

Arellano, M., & Bond, S. (1991). Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. The Review of Economic Studies, 58 (2), 277-297.

Baltagi, B.H. (1995). Econometric Analysis of Panel Data (Vol. 2). New York: Wiley.

Baum, C.F., Caglayan, M., & Ozkan, N. (2005). The second moment matter: The response of bank lending behavior to macroeconomic uncertainty. http://www.gla.ac.uk/media/media_22217_en.pdf

Behzadi, M. (2015). The effect of symmetrical fluctuations in oil prices on the overdue receivables of the Iran's banking network. (Master's Thesis). Islamic Azad University, Tehran Branch, Iran.

Boyd, J.H., Levine, R., & Smith, B.D. (2001). The impact of inflation on financial sector performance. Journal of Monetary Economics, 47(2), 221-248.

Chan, Y. S., & Kanatas, G. (1985). Valuations and the Role of Collateral in Loan Agreements. Journal of Money, Credit and Banking, 17(1), 84-95.

Finn, M.G. (2000). Perfect Competition and the Effects of Energy Price Increase on Economic Activity. Journal of Money, Credit and Banking, 32(3), 400-416.

Foos, D., Norden, L., & Weber, M. (2010). Loan growth and riskiness of banks. Journal of Banking & Finance, 34(12), 2929-2940.

Greene, W.H. (2003). Econometric Analysis. New Jersey: Pearson Education.

Hamilton, J.D. (1983). Oil and the Macroeconomy since World War II. Journal of Political Economy, 91 (2), 228-248.

Heidari, H., Sadeghpour, S., & Dehghandorost, M. (2017). The Relationship between Inflation Uncertainty and the Bank Loan Facilities Granted. Monetary & Financial Economics (Previously Knowledge & Development), 24(14), 135-154.

Hosseini, E., & Rezagholizadeh, M. (2011). Analysis of the Fiscal Sources of Inflation in Iran Giving Special Emphasis to Budget Deficits. Quarterly Journal of Sustainable Growth and Development (Previously Quarterly Journal of Economic Research), 10(1), 43-70.

Idris, I.T., & Nayan, S. (2016). The Joint Effects of Oil Price Volatility and Environmental Risks on Non-Performin Loans: Evidence from Panel Data of Organisation of the Petroleum Exporting Countries. International Journal of Energy Economics and Policy, 6(3), 522-528.

Karimkhani, A.A., & Forati, M. (2012). Investigating the effect of macroeconomic variables on banks' resources and expenditures. Sepah Bank, Risk Research and Control Department.

Khandelwal, P., Miyajima, K., & Santos, A. (2016). The Impact of Oil Prices on the Banking System in the GCC. IMF Working Paper, 16/161. https://www.imf.org/external/pubs/ft/wp/2016/wp16161.pdf

Khodadadi, F., & Mehrara, M. (2017). Effect of macroeconomic fluctuations on the lending behavior of commercial banks in Iran. Journal of Islamic Economics & Banking, 6(18), 23-39.

Lashkary, M., Bafandeh, S., Hasannia, N., & Goli, A. (2015). Effects of Macroeconomic Variables on the Lending Behavior of Bank Maskan of Iran. Quarterly Journal of Sustainable Growth and Development (Previously Quarterly Journal of Economic Research), 15(3), 119-134.

Lee, C.C., & Lee, C.C. (2019). Oil price shocks and Chinese banking performance: Do country risks matter? Energy Economics, 77, 46-53.

Lee, C.C., Lee, C.C., & Ning, S.L. (2017). Dynamic relationship of oil price shocks and country risks. Energy Economics, 66, 571-581.

Mehrara, M., & Mojab, R. (2010). The Links between Inflation, Inflation Uncertainty, Output and Output Uncertainty in Iran. Journal of Monetary and Banking Researches (Previously Journal of Money and Economic), 1(2), 1-30.

Mehrara, M., Taiebnia, A., Dehnavi, J. (2013). Determinants of Inflation in Iran Based on STR Approach. Journal of Economic Research (Tahghighat-e-Eghtesadi), 47(4), 221-242.

Olokoyo, F.O. (2011). Determinants of Commercial Banks’ Lending Behavior in Nigeria. International Journal of Financial Research, 2(2), 61-72.

Said, A. (2015). The Influence of Oil Prices on Islamic Banking Efficiency Scores during the Financial Crisis: Evidence from the MENA Area. International Journal of Finance & Banking Studies, 4(3), 35-43.

Saif-Alyousfi, A.Y., Saha, A., & Md-Rus, R. (2018). Impact of oil and gas price shocks on the non-performing loans of banks in an oil and gas-rich economy: Evidence from Qatar. International Journal of Bank Marketing, 36(3), 529-556.

Sameti, M., Dalali, R., & Karnameh, H. (2012). The Impact of Macroeconomic Instability on the Banking Sector Lending Behavior in Iran (1974-2009). Trend of Economic Research, 19(60), 5-28.

Shayhaki, M., & Khorram, T. (2017). The Relationship between Unemployment Rate, Oil Price and Interest Rate in Iran. Quarterly Journal of the Macro and Strategic Policies, 4(16), 115-134.

Somoye, R.O.C., & Ilo, B.M. (2009). The Impact of Macroeconomic Instability on the Banking Sector Lending Behaviour in Nigeria. Journal of Money, Investment and Banking, 7, 88-100.

Talavera, O., Tsapin, A., & Zholud, O. (2006). Macroeconomic Uncertainty and Bank Lending: The Case of Ukraine. DIW Discussion Papers, 637. https://www.econstor.eu/bitstream/10419/18530/1/dp637.pdf

Xu, C., & Xie, B. (2015). The Impact of Oil Price on Bank Profitability in Canada. (Master's Thesis). Simon Fraser University, Canada. http://summit.sfu.ca/system/files/iritems1/15821/Xie%2C%20Bingqing%20and%20Xu%2C%20Chengcheng.pdf

Zomorrodi, M., & Golshahi, M. (2017). The effect of oil price changes on the amount of non-current facilities of banks: A case study of Iran. 27th Annual Conference on Monetary and Currency Policies (Financial Stability, the Basis of Sustainable Economic Growth). Tehran: IRIB International Conference Center.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Submission of manuscripts implies that the work described has not been published before (except in the form of an abstract or as part of thesis), that it is not under consideration for publication elsewhere and that, in case of acceptance, the authors agree to automatic transfer of the copyright to the Journal for its publication and dissemination. Authors retain the authors' right to use and share the article according to a personal or instutional use or scholarly sharing purposes; in addition, they retain patent, trademark and other intellectual property rights (including research data).

All the articles are published in the Journal under the Creative Commons license CC-BY-SA (Attribution-ShareAlike). It is allowed a commercial use of the work (always including the author attribution) and other derivative works, which must be released under the same license as the original work.

Up to Volume 21, this Journal has been licensing the articles under the Creative Commons license CC-BY-SA 3.0 ES. Starting from Volume 22, the Creative Commons license CC-BY-SA 4.0 is used.