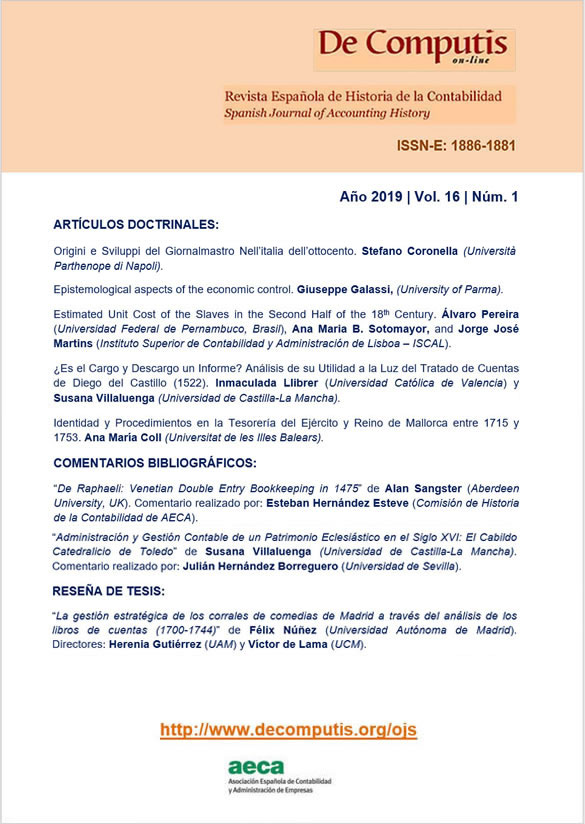

Charge and discharge as a financial report, how to understand his utility through tratado de cuentas by Diego del Castillo (1522)

DOI:

https://doi.org/10.26784/issn.1886-1881.v16i1.345Keywords:

Charge and Discharge, Usefulness, Financial reports, paradigm of profitAbstract

Accounting records support the economic information and control system of the organizations.

Accounting reports are compilations of financial information that are derived from them. Financial reports are useful to provide information to determine and evaluate the management carried out by the steward with the resources entrusted to him and serve as a base for making business decisions.

Despite charge and discharge has had multiple functions related with control and accountability, usually it has been considered more inefficient than the double entry bookkeeping. Some authors claim charge and discharge does not constitute any accounting system because it is not the result of a prior interrelation between all elements of a business transaction. That is why it is less valid than double entry bookkeeping to provide useful

information to make a business decision.

This work seek to answer two questions: the first one, within an historical framework, could the charge and discharge be useful for helping the principal to make a decision about the management of their properties? The second one is, is the charge and discharge a financial report? To answer them we analyses the qualitative characteristics of accounting information, which Diego del Castillo in 1522, describe in Tratado de Cuentas.

Downloads

References

Adrados Sastre, Mª C. (1996) "Sistemas de información contable", Ensayos sobre contabilidad y economía: en homenaje al profesor Ángel Sáez Torrecilla, 1, 17-30. Madrid: Instituto de Contabilidad y Auditoría de Cuentas (ICAC).

Asociación Española de Contabilidad y Administración de Empresas, AECA (2012) Marco conceptual de la información financiera (1ª edición revisada en 2012). Madrid: AECA.

American Institute of Certified Public Accountants, ICPA (1973) Report of the Study Group on the Objectives of Financial Statements, New York.

Araujo Ensuncho, J. A. (2007) "Los recursos: objeto de estudio de la Contabilidad", Contaduría, 50, 177-186.

Baxter, W.T. (1980) "The Account charge and discharge", The Accounting Historians Journal, 7(1), 69-71. https://doi.org/10.2308/0148-4184.7.1.69

Calvo Cruz, M. (2005) "Rendición de cuentas de los administradores del obispado en sede vacante en España, siglos XVIII-XIX", Revista de Contabilidad, 8(15), 169-182.

Cañibano Calvo, L. (1974) "El concepto de Contabilidad como un programa de investigación", Revista Española de Financiación y Contabilidad, 3(7), 34-45.

Capelo Bernal, M. (2007) "La contabilidad en el almacén de Agüera entre los siglos XVIII y XIX. Un estudio sobre su evolución desde el registro por cargo y data hasta la partida doble", Revista Española de Financiación y Contabilidad, 36 (135), 453-479.

Castillo, D. del (1542) Tratado de Cuenta hecho por el licenciado Diego del Castillo natural de la ciudad de Molina, 2ª ed. Salamanca: Imprenta de Juan de Junta.

Cowton, C.J. y A.J. O'shaughnessy (1991) "Absentee Control of Sugar Plantations in the British West Indies", https://doi.org/10.1080/00014788.1991.9729415

Accounting and Business Research, 22(85), 34-45. https://doi.org/10.1080/00014788.1991.9729415

Chambers R. J. (1966) Accounting Evaluation and Economic Behavior, Prentice Hall, Englewood Cliffs.

Gómez Villegas, M. (2004) "Una evaluación del enfoque de las Normas Internacionales de Información

Financiera (NIIF) desde la teoría de la contabilidad y el control", INNOVAR. Revista de Ciencias Administrativas y Sociales, 24(24), 112-131. http://www.redalyc.org/articulo.oa?id=81802409

Gjesdal, F. (1981) "Accounting for stewardship", Journal of Accounting Research, 19(1), 208-231. https://doi.org/10.2307/2490970

Hendriksen, E. S. (1974) Teoría de la Contabilidad. México: Unión Tipográfica Editorial Hispano Americana.

Hendriksen, E. S. (1982) Accounting Theory (4ª ed). Londres: Longman Higher Education Publisher.

Hernández Esteve, E. (1998) "Las contadurías de libros de la Contaduría Mayor de Hacienda y la contabilidad de cargo y data en la gestión del imperio español (siglo XV al XVII)", II Encuentro de trabajo sobre la Historia de La Contabilidad en España (AECA), Mairena de Aljarafe, Sevilla, 1-78.

Hernández Esteve, E. (2002) "La Historia de la Contabilidad", Revista de Libros, 67-68. En https://www.revistadelibros.com/articulo_imprimible.php?art=3850&t=articulos [Consulta: 09/02/2019].

Hernández Esteve, E. (2005) "Reflexiones sobre la naturaleza y los orígenes de la contabilidad por partida doble", Pecvnia, 1, 93-124. https://doi.org/10.18002/pec.v0i1.743

Hernández Esteve, E. (2007) "La Contabilidad por cargo y data y sus textos en el panorama contable español de los siglos XVI y XVII", Homenaje al Prof. Dr. D. Luis Pérez Pardo, 161-224, Barcelona: Escola Universitaria d'Estudis Empresarials de Barcelona.

International Accounting Standars Board, IASB (2003) Normas internacionales de información financiera. London: CISS.

International Accounting Standars Board, IASB (2006) Presentación de estados financieros (NIC-1). London: CISS.

Jensen, M. C. y W. H. Meckling (1976) "Theory of the Firm: Managerial Behaviour, Agency Costs and Ownership Structure", Journal of Financial Economics, 3(4), 305-360. https://doi.org/10.1016/0304-405X(76)90026-X

Laughlin, R. C. (1987) "Accounting systems in organizational contexts: A case for critical theory", Accounting, Organizations and Society, 12(5), 479-502. https://doi.org/10.1016/0361-3682(87)90032-8

López Pérez, M. V. (1999) Captación e interpretación en Contabilidad. Tesis Doctoral, Universidad de Granada.

Mattessich, R. (1964) Accounting in Analytical Methods: Measurement and Projection of Income and Wealth in the Micro- and Macro-economy. Illinois: Homewood.

Miley, F.M. y A. F. Read (2016) "Spies, debt and the well-spent penny: accounting and the Lisle agricultural estates 1533-1540", Accounting History Review, 26(2), 83-105. https://doi.org/10.1080/21552851.2016.1187638

Napier, C. (1991) "Aristocratic Accounting: the Bute Estate in Glamorgan 1814-1880", Accounting and Business Research, 21(82), 163-174. https://doi.org/10.1080/00014788.1991.9729829

Noke, C. (1981) "Accounting for Bailiffship in Thirteenth Century England", Accounting and Business. Research, 11(42), 137-151. https://doi.org/10.1080/00014788.1981.9729691

Prieto, B.; Maté, L. y J. Tua (2006) "The accounting records of the Monastery of Silos throughout the eighteenth century: the accumulation and management of its patrimony in the light of its accounts books", Accounting History, 11(2), 221-256. https://doi.org/10.1177/1032373206063115

Ruiz Rodríguez, M. C. (2012) "Debate de la utilidad de la información contable sobre intangibles", Revista de Estudios Empresariales, 1, 149-172.

Staubus, G. J. (1961) A Theory of Accounting to Investors. California: University of California Press.

Staubus, G. J. (1976) "The multiple-criteria approach to making accounting decisions", Accounting and Business Research, 6(24), 276-288. https://doi.org/10.1080/00014788.1976.9728694

Sterling, R. (1970) Theory of Measurement of Enterprise Income, Lawrence: University of Kansas Press.

Thinck, A. (1999) "Accounting in the late medieval town: the account books of the stewards of Southampton in the fifteenth century", Accounting Business and Financial History, 9(3), 265-290. https://doi.org/10.1080/095852099330214

Villacorta Hernández, M. A. (2006) "Marco conceptual del IASB", Técnica Contable, 58(686), 47-54.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2019 Inmaculada Llibrer Escrig, Susana Villaluenga de Gracia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.