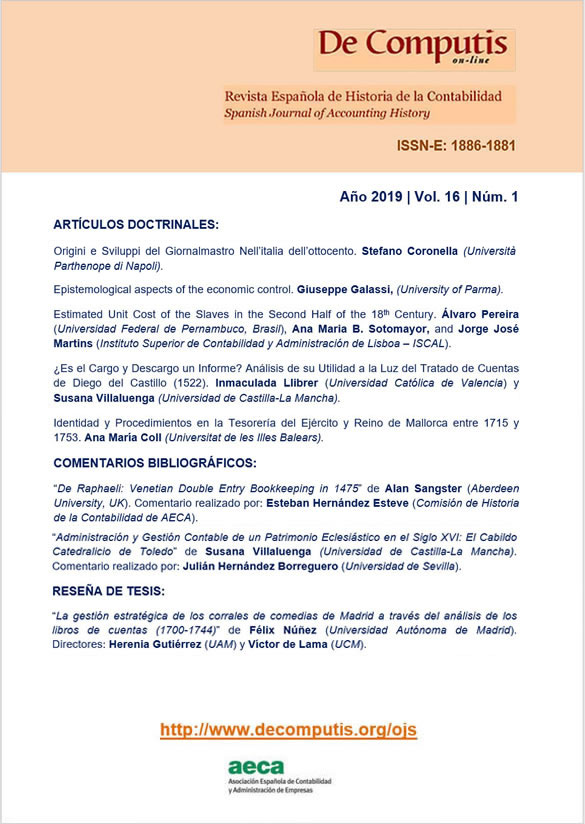

Epistemological aspects of the economic control

DOI :

https://doi.org/10.26784/issn.1886-1881.v16i1.343Mots-clés :

‘Economia aziendale’, Economic control, ethical standards, probability, scientific methodology, realityRésumé

Epistemology is essential for probing the fundamental issues of the management sciences, included the ‘economic control process’. The paper aims to highlight the connections between economia aziendale, the typical Italian research program, as well as the traditional research programs of Continental European Countries, with a theoretical reconstruction founded also on modern epistemological issues. One fundamental question, for instance, is about the ‘true’ information or knowledge conveyed by a financial statement, taking into account that economia aziendale, the general system, was conceived as consisting of interrelated sub-systems of management, organization and data gathering for planning and control. The ‘economic control’, both antecedent, concomitant and subsequent, refers to the azienda, the economic entity, that is to every kind of economic unit, not only to the business enterprise.The ‘economic control’ is concerned with social responsibility, ethical conduct, as well as with ‘evidence’, ‘proof’, opinions and judgments. The credibility of a hypothesis depends on the associated evidence, so it is not independent from the strength of the entire argument, ‘evidence plus hypothesis’. The ‘degree of confidence’ implies probability, specifically the bayesian approach for modifying early prior valuations in the light of further information, obtaining revised posterior probabilities. The essential requirement of a proof is that it is ‘psychologically satisfying’; the problem of the controller’s independence stresses the controlling ethical standards. The code of ethics and rules of conduct should serve to identify responsibilities and aims involved – greater accountability through better information about ends and means – and to underline the need for a theoretical foundation about ethics of accounting and economic controlling. Of particular interest is the dichotomy ‘subjective-objective’ related also to economic reality, every kind of reality, included physical as well as cultural ones. This brings directly in the field of accounting and ‘entity economics’ metaphors. The economic controlling process is tightly connected to interpersonal analogy and to the ‘social agreement approach’ to ‘objectivity’ and scientific methodology. There is often no possible control through ‘correspondence’ with definite aspects of reality, economic-financial events themselves. System theorists employ many concepts that correspond to ‘independent reality’ only through ‘indicator hypotheses’ such as ‘business income’ magnitude, the best proxy of the economic efficiency of the ‘business entity’.

Téléchargements

Références

Andrei, P. (2010) 'Il contributo di Fabio Besta allo sviluppo degli studi di Ragioneria pubblica', Rivista Italiana di Ragioneria e di Economia Aziendale 3-4: 1-85.

Azzini, L. (1982) Istituzioni di economia d'azienda (1st ed. 1980), Milan: Giuffrè Editore.

Ackoff, R. L. (1962) Scientific Method. Optimizing applied research decisions, New York: John Wiley & Sons.

Adelberg, A. H.(1975) 'Auditing on the march: ancient times to the twentieth century', Internal Auditor Nov.-Dec.: 35-47.

Besta, F. (1891, 1910, 1916) La ragioneria, vols. I, II, III, first vol. published in 1891, second vol. 1910 and third vol. 1916 (reprint of the three vols., Milan: Vallardi, 1922).

Braithwaite, R. B. (1955) Scientific explanation. A study of the function of theory, probability and law in science, London: Cambridge University Press.

Brewster, M. (2003) Unaccountable: how the accounting profession forfeited a public trust, Hoboken, N. J.: John Wiley & Sons.

Bunge, M. (1967) Scientific Research, vols. 2: The search for truth, Berlin-New York: Springer Verlag (revised edition: Philosophy of Science, New Brunswick: Transaction, 1998).

Bunge, M. (1974) Treatise on basic philosophy, vol. 2: Interpretation and truth, Dordrecht: Reidel. https://doi.org/10.1007/978-94-010-9920-2

Bunge, M. (1985) Treatise on basic philosophy, vol. 7, part II: Life Science, social science and technology, Dordrecht:

https://doi.org/10.1007/978-94-009-5287-4 Reidel.

Bunge, M. (1989) Treatise on Basic Philosophy, vol. 8: the good and the right, Dordrecht: Reidel. https://doi.org/10.1007/978-94-009-2601-1

Cameran, M., Ditillo, A., and Pittinicchio, A (2017) Auditing teams. Dynamics and efficiency, London and New York: https://doi.org/10.4324/9781315544953 Routledge.

Carnap, R. (1962/1950) Logical foundations of probability, London: Routledge and Kegan Paul.

Churchman, C. W. (1971) The design of inquiring systems: basic concepts of systems and organization, New York, London: Basic Books.

Clarke, F. L., and Dean, G. V. (2007) Indecent disclosure: gilding the corporate lily, Melbourne: Cambridge University Press.

Clarke, F. L., Dean, G. W., and Egan, M. (2014) The unaccountable & ungovernable corporation: companies' use-bydates close in, London and New York: Routledge. https://doi.org/10.4324/9781315867571

Clarke, F. L., Dean, G. W., and Oliver, K. G. (2003) Corporate collapse. Regulatory, accounting and ethical failure, 2nd

revised ed., Cambridge: Cambridge University Press.

Clarke, F. L., Dean G. W., and Persson, M. (2019) Accounting Thought and practice reform. Ray Chambers' odyssey,

https://doi.org/10.4324/9780429442278 New York and London: Routledge.

De Fond, M. and Zhang, J. (2014) 'A review of archival auditing research', Journal of Accounting and Economics 58:

https://doi.org/10.1016/j.jacceco.2014.09.002275-326.

Devine, C. T. (1999) Essays in accounting theory. A capstone, New York & London: Garland Publishing, Inc.

Felix Jr., W. L. and Kinney Jr., W. R. (1982) 'Research in the auditor's opinion formulation process: state of the art' The Accounting Review 57 (April): 245-71.

Ferrero, G. (1968) Istituzioni di economia d'azienda, Milan: Giuffrè Editore.

Francis, J. R. (2004) 'What do we know about audit quality?', The British Accounting Review 36: 345-68. https://doi.org/10.1016/j.bar.2004.09.003

Francis, J. R. (2011) 'A framework for understanding and researching audit quality', Auditing: A Journal of Practice & Theory 30 (2): 125-52. https://doi.org/10.2308/ajpt-50006

Gaa, J. C. (1988) 'The auditing profession and society: Prisoners of a dilemma', A profession in transition: The ethical and legal responsibilities of accountants, Proceedings of the third annual research symposium, Chicago: De Paul University, School of Accountancy.

Gaa, J. C. (1994) The ethical foundations of public accounting, Vancouver: CCGA Research Foundation.

Galassi, G. (1974) Misurazioni differenziali, misurazioni globali e decisioni d'azienda, Milan: Giuffrè Editore.

Galassi G. (1978) Sistemi contabili assiomatici e sistemi teorici deduttivi. Prime proposizioni per una teoria generale della ragioneria, Bologna: Patron Editore.

Haak, M., Muraz, M. and Zieseniss, R. (2018) 'Joint audits: does the allocation of audit work affect audit quality and audit fees?', Accounting in Europe 15 (1): 55-80. https://doi.org/10.1080/17449480.2018.1440611

Ijiri, Y. (1967) The foundations of accounting measurements. A mathematical, economic and behavioral inquiry, Englewood Cliffs, N. J.: Prentice Hall.

Ijiri, Y. and Kaplan, R. (1971) 'A model for integrating sampling objectives in auditing', Journal of Accounting Research (1): 73-87. https://doi.org/10.2307/24902039

Jiang, J. (Xuefeng), Wang, I. Y. and Wang, K. P. (2019) 'Big N auditors and audit quality: new evidence from quasiexperiments', The Accounting Review 94 (1): 205-27. https://doi.org/10.2308/accr-52106

Keynes, J. M. (1921) A treatise on probability, London: MacMillan.

Knechel, W. R., Krishnan, G. V., Pevzner, M., Shefchik, L. B. and Velury, U. K. (2013) 'Audit quality: insights from the academic literature', Auditing: a Journal of Practice and Theory 32, Supplement 1: 385-421.

Liang, P. J. and Zhang, G. (2019) 'On the social value of accounting objectivity in financial stability', The Accounting Review 94 (1): 229-48.

Limperg Jr., T. (1926) 'The accountants certificate in connection with the accountants responsibility', Het International Accountants Congress, Purmerend: J. Muusses: 85-104.

Limperg Jr., T. (1932-33) 'De functievan den accountant an de leervan her gewekte vertouen', Maandblat vorAccountancy and Befrjiseconomie 9: 151-4, 173-77; 10: 193-97 (English translation: 'The function of the accountant and the theory of inspired confidence', The social responsibility of the auditor, Amsterdam: Limperg Institute, 1985).

Masini, C. 81955) La dinamica economica nei sistemi dei valori d'azienda: Valutazioni e rivalutazioni, Milan: Giuffrè Editore.

Masini, C. (1960) L'organizzazione del lavoro nell'impresa, Milan: Giuffrè Editore.

Masini, C. (1961) L'ipotesi nella dottrina e nelle determinazioni dell'economia d'azienda, Milan: Giuffrè Editore.

Masini, C. (1964) La struttura dell'impresa, Milan: Giuffrè Editore.

Masini, C. (1979) Lavoro e risparmio. Economia d'azienda, 2nd ed., Turin: Utet (1st ed. 1970).

Mattessich, R. (1978) Instrumental reasoning and system methodology. An epistemology of the applied and social

https://doi.org/10.1007/978-94-010-9431-3 sciences, Dordrecht: Reidel.

Mattessich, R. (2000) The beginning of accounting and accounting thought. Accounting practice in the Middle East (8000 B. C. to 2000 B. C.) and accounting thought in India (300 B. C. and the middle Ages).

Mattessich, R. (2014) Reality and accounting. Ontological explorations in the economic and social sciences, London and New York: Routledge. https://doi.org/10.4324/9780203798737

Mautz, R. F. and Sharaf, H. A. (1961) The philosophy of auditing, Sarasota: American Accounting Association.

Mazza, T. and Azzali, S. (2018) 'Information technology controls quality and audit fees: evidence from Italy', Journal of Accounting, Auditing & Finance 33 (1): 123-46.

Moonitz, M. and Stamp, E. (1978) International auditing standards, London: Prentice Hall International.

Myrdal, G. (1970) Objectivity in social research, London: Druckworth.

Niemi, L., Knechel, W. R. and Ojala, H. (2018) 'Responsiveness of Auditors to the audit risk standards: unique evidence https://doi.org/10.2139/ssrn.2970881from big 4 audit firms', Accounting in Europe 15 (1): 33-54.

Onida, P. (1951) Le discipline economico-aziendali. Oggetto e metodo, 2nd revised ed., Milan: Giuffrè Editore.

Onida, P. (1963) Economia d'azienda, Turin: Utet.

Ponemon, L. A. and Gabhard, D. R. (1993) Ethical reasoning in accounting and Auditing, Vancouver: CCGA Research Foundation.

Sargiacomo, M., Servalli, S. and Andrei, P. (2012) Fabio Besta: 'Accounting thinker and

accounting theory pioneer', https://doi.org/10.1080/21552851.2012.728904 Accounting History Review 22 (3): 1-37.

Simunic, D. A. (1984) 'Auditing, consulting and auditor independence', Journal of Accounting Research 22 (Summer): https://doi.org/10.2307/2490671679-702.

Simunic, D. A. (2019) Review of 'Gow, I. D. and Kells, S. The big four: The curious past and perilious future of the global accounting monopoly, Oakland, CA: Berret-Koehler Publishers', The Accounting Review 94 (1): 353-56. https://doi.org/10.2308/accr-10638

Stevens, S. (1946) 'On the theory of scales of measurement', Science 103: 677-80. https://doi.org/10.1126/science.103.2684.677

Strogatz, S. (2008) Chaos: the teaching companion, Chantilly, VA: The Great Courses.

Wittengstein, L. von (1961/1922) Tractatus logico-philosophicus, London: Routledge and Kegan Paul.

Wyatt, A. R. (2004) 'Accounting professionalism. They just do not get it', Accounting Horizons 18 (March): 45-53. https://doi.org/10.2308/acch.2004.18.1.45

Zappa, G. (1937) Il reddito d'impresa. Scritture doppie, conti e bilanci di aziende commerciali, second edition, Milan: Giuffrè Editore (3rd printing of 2nd ed. 1950).

Zappa, G. (1957) Le produzioni nell'economia delle imprese, three tomes, Milan: Giuffrè Editore.

Zappa, G. (1962, published posthumuously) L'economia delle aziende di consumo, Milan: Giuffrè Editore.

Zeff, S.A. (2018) 'My accounting theory seminar' Accounting Historians Journal 45, 1 (June): 138-140. https://doi.org/10.2308/aahj-10574

Téléchargements

Publiée

Comment citer

Numéro

Rubrique

Licence

© Giuseppe Galassi 2019

Ce travail est disponible sous licence Creative Commons Attribution - Pas d’Utilisation Commerciale - Partage dans les Mêmes Conditions 4.0 International.